Advertisement

Advertisement

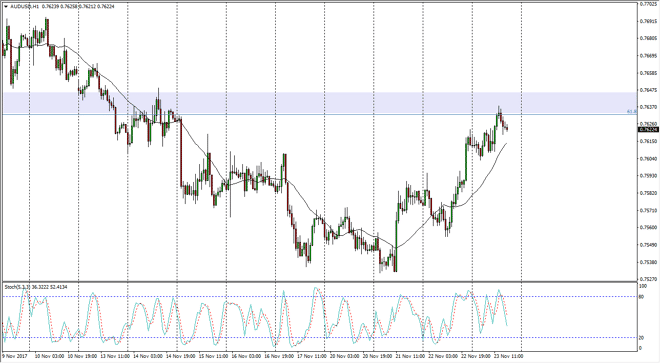

AUD/USD Price Forecast November 24, 2017, Technical Analysis

Updated: Nov 24, 2017, 05:04 GMT+00:00

The Australian dollar rallied during the trading session on Thursday, as American traders were a way for Thanksgiving. This led to a bit of thin trading

The Australian dollar rallied during the trading session on Thursday, as American traders were a way for Thanksgiving. This led to a bit of thin trading later in the day, but quite frankly with the US dollar and defended we could not break out to the upside, which solidifies to me that we are most certainly in a negative trend. It looks as if we are trying to roll over a little bit, and if we were to break down below the 0.76 level again, I think that the 0.75 level will be targeted as it was just a few days ago. A breakdown below that level gets things looking very bearish, and of course gold needs to rally for the Australian dollar to pick up strength longer-term for what I can see.

The Federal Reserve raising interest rates towards the end of the year is of course going to help the US dollar, but if they look bullish enough to raise rates a couple of times going forward, that should really start to extend the selling pressure. If we do break above current levels right now, we could go as high as 0.7750, where I expect to see even more bearish pressure based upon longer-term charts and the significance of that region. I am a seller of the Australian dollar, and I don’t have any interest in buying currently, although I do recognize that the short-term buying opportunity does exist. Fundamentally speaking, the US dollar should continue to strengthen, and if we get any type of geopolitical concern or disruption, it’s likely that the Australian dollar will get pummeled as well. In general, I believe that selling the rallies continues to be the way to go, but we do of course need some type of confirmation.

AUD/USD Video 24.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement