Advertisement

Advertisement

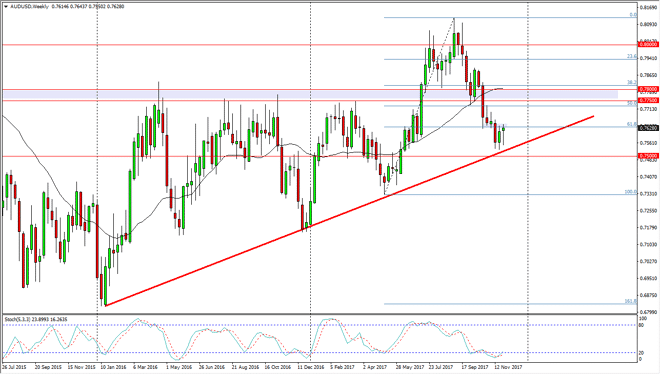

AUD/USD Price forecast for the week of December 4, 2017, Technical Analysis

Updated: Dec 2, 2017, 07:41 GMT+00:00

The Australian dollar spent most of the week falling, but then turned around and rallied enough to form a hammer. However, there are resistive areas just above that could cause issues.

The Australian dollar fell initially during the week, but found enough support underneath to turn around and form a hammer. The hammer formed just above the uptrend line, but I also see that there are shooting stars from a couple of weeks ago, and that means that the market is probably going to struggle in this area. Part of the bounce on Friday was due to the General Flynn announcement that he was going to testify against the White House. That of course have the US dollar falling, and it looks likely that we are going to continue to go back and forth, and I do think that eventually we could try to rally towards the 0.7750 level above, which has been resistive. If we can break down below the uptrend line, the market should send the market down to the 0.75 handle underneath, as it is massively supportive. If we were to break down below there, that would be a very negative sign for the Aussie, but right now I think it’s likely that we will see a lot of back and forth action over the next several sessions. I think that gold needs to break out to the upside significantly for the Aussie to continue to go higher, and at this point I believe that longer-term traders are going to struggle to find a nice opportunity in this market. However, we have a couple of levels that given enough momentum, we could break through and get a nice trading opportunity for a larger move. I just don’t see that happening in the short term.

AUD/USD Video 04.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement