Advertisement

Advertisement

Can This Week’s Economic News Stall USD Decline?

By:

Widespread unrest in the global financial markets, triggered by previous week’s Chinese move to devalue Yuan, kept maintaining its effect during the last

Widespread unrest in the global financial markets, triggered by previous week’s Chinese move to devalue Yuan, kept maintaining its effect during the last week. The Forex market, not being an exception, also witnessed considerable moves wherein safe havens, like Gold and JPY, rallied while short covering in the EUR fueled the regional currency against majority of its counterparts. The US Dollar Index (I.USDX), however, faced noticeable downside with consecutive second negative weekly closing, testing the lowest level in two months, as weaker than expected Inflation numbers and not so hawkish FOMC minutes cooled down speculations concerning Fed rate lift-off during September meeting. Commodity currencies, namely, AUD, NZD and CAD, registered heavy declines and the Crude prices plunged to the levels last seen during March 2009.

Looking forward, GDP numbers from UK, US and Switzerland, coupled with US Durable Goods Orders and Consumer Confidence, are likely to become market catalysts for the upcoming week. Moreover, US Housing market details, German Ifo Business Climate and the Preliminary CPI, together with New-Zealand Inflation Expectations q/q and Trade Balance, are likely to provide additional source of market volatility. Let’s discuss them in detail.

US GDP, Consumer Confidence and Durable Goods Orders To Determine USD Fate

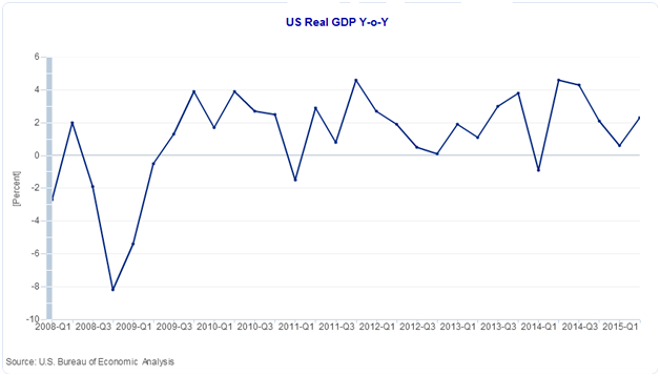

As weaker than expected Inflation numbers fading hopes that the Federal Reserve could opt for interest rate hike during its September monetary policy meeting, market players are likely to concentrate more on the second estimation of Q2 2015 GDP numbers in order to determine the strength of US Economy, in-turn signaling near-term USD moves.

Even if the US Inflation didn’t match the mark, US FOMC members were not pessimistic, if not the hawkish, and kept supporting the first interest rate hike since 2006 during the current year. They mentioned that the labor market improvements were better and the economy is also strengthening from its previous quarterly decline of -0.2% (Q-o-Q). Should this second estimate of Q2 2015 GDP figure, scheduled for publish on Thursday, matches the 3.2% mark, against Flash version showing 2.3% gains, speculations concerning interest rate hike in September gets stronger, favoring rejuvenation of USD Bulls. However, a weaker than expected mark, or a plunge near the prior -0.2% could threaten the US Fed policy makers from introducing interest rate hike, providing additional strength to the USD bears and forcing the greenback to test lows against majority of its counterparts.

Moreover, the official reading of CB Consumer Confidence, scheduled for Tuesday, and the monthly Durable Goods Orders, up for publishing on Wednesday, together with details of New Home Sales and Existing Home Sales, scheduled to be published on Tuesday and Thursday respectively, are also important readings that could help determine near-term USD moves. While the Consumer Confidence index is expected to mark 92.8 mark against 90.0 number and the New Home Sales, together with Existing Home Sales, likely registering welcome numbers, to 512K v/s 482K & an increase of 1.3% compared to previous decline of -1.8%, the Durable Goods Orders are expected to mark an negative print of -0.5% against previous 3.5% growth. Also, the Core Durable Goods Orders are likely to show 0.3% increase against its earlier 0.6% revised down figure.

With the recent market behavior pushing away the September rate hike speculations, only strong economic numbers could provide life to the USD Bulls, else September lift-off seems unlikely and weaker economic marks could trigger further weakness for the greenback.

German Numbers And UK GDP Are Likely Catalyst For Near-Term EUR & GBP Moves

Recent short-covering and a relief at Greece have given considerable strength to the EUR in recent times while weakening concerns for BoE’s sooner rate hike kept pulling back the GBP. This week’s German numbers, mainly Ifo Business Climate and Prelim CPI m/m, scheduled for Tuesday and Friday, coupled with Friday’s second estimate of Q2 2015 UK GDP reading, are likely catalyst to help determine near-term EUR & GBP moves respectively.

Index showing German Business Confidence is likely to weaken a bit from its 108.00 mark to 107.6 print while the Prelim CPI consensus favors a negative reading of -0.1% compared to +0.2% prior. Moreover, the UK GDP is likely to match its initial estimations of 0.7% growth. Hence, a negative Inflation into the Europe’s largest economy and fading business confidence may dent some of the recent EUR gains while lesser than forecast UK GDP numbers could hurt the speculations concerning BoE’s near-term rate hike, providing additional declines by the GBP.

Swiss GDP and New-Zealand Numbers Are The Rest To Observe This Week

Recently, uncertainty into the global financial markets have favored the safe haven demand of CHF while plunge of commodity basket kept providing additional weakness to the NZD, a commodity currency. New-Zealand Inflation Expectations q/q and the Trade Balance details, scheduled for Tuesday and Wednesday respectively, together with the Swiss GDP q/q, up for Friday release, are rest of the data points scheduled during the week to foresee near-term forex moves.

With the New-Zealand Inflation Expectations trading near record lows, 1.8% marked in February, an actual number lesser than the previous 1.9%, registered in May, can magnify the NZD weakness. Moreover, the Trade Balance is also testing the lowest levels since January and a wider deficit, as expected -600M against prior -60M, could mark the new 2015 lows of Trade numbers, triggering widespread NZD decline. The Swiss GDP number, however, is likely to ease a bit from its lowest since September 2009, the -0.2%, to the -0.1% mark and can help increase the current strength of the CHF should the actual number prints either positive mark or satisfy consensus.

Follow me on twitter to discuss latest markets events @Fx_Anil

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement