Advertisement

Advertisement

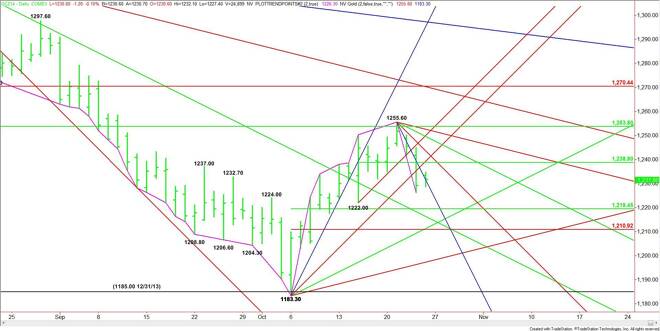

Comex Gold Futures (GC) Technical Analysis – October 27, 2014 Forecast

By:

December Comex Gold futures posted an inside day on Friday, suggesting trader indecision and impending volatility. This type of trading could continue

December Comex Gold futures posted an inside day on Friday, suggesting trader indecision and impending volatility. This type of trading could continue this week as many traders are likely to take to the sidelines ahead of Wednesday’s U.S. Federal Reserve Monetary Policy announcement and Friday’s Euro Zone consumer inflation data.

Technically, the main trend is down on the daily chart. The short-term range is $1183.30 to $1255.60. Its retracement zone at $1219.40 to $1211.00 is the next likely downside target.

Holding Friday’s low at $1226.30 and the steep downtrending angle at $1223.60 today will be signs that sellers are lightening up. This could produce a short-covering rally back into a short-term pivot at $1238.80 or a downtrending angle at $1243.30.

Traders are likely to react to the movement by the U.S. Dollar today. A rally will take the market to $1238.80 while a hard sell-off will likely trigger a break into $1219.40.

Take what the market give you today if the volume and volatility are below average.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement