Advertisement

Advertisement

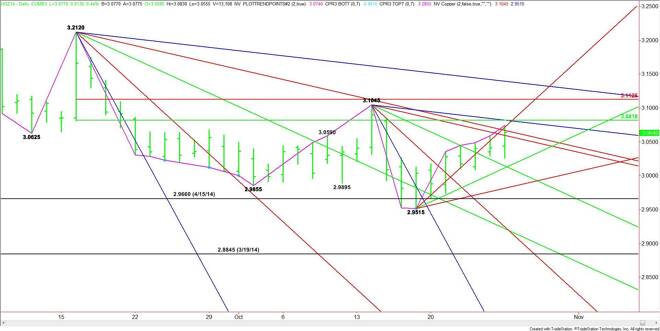

Comex High Grade Copper Futures (HG) Technical Analysis – October 28, 2014 Forecast

By:

December Comex High Grade Copper futures closed in a strong position to breakout to the upside. The close at 3.0640 has put the market on the bullish side

The main range is 3.2120 to 2.9515. Its retracement zone at 3.0820 to 3.1125 is the next likely target. Since the main trend is down, sellers may show up in this zone to defend the trend so copper is still vulnerable to a short-term break despite the recent rally.

The last main top at 3.1045 falls inside the retracement zone. Taking out this price will turn the main trend to up on the daily chart. This could create enough upside momentum to take out the Fibonacci level at 3.1125 and challenge another long-term downtrending angle at 3.1370.

Besides breaking through the resistance, another sign of strength will be overcoming a steep uptrending angle at 3.0915.

On the downside, a failure to follow-through to the upside after taking out resistance levels will be a sign that sellers are still in control. This could trigger a break back into the nearest uptrending angle at 3.0215.

Look for a labored rally today until buyers can sustain a rally over 3.0820. The daily chart opens up over this level with potential targets at 3.1045 and 3.1125.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement