Advertisement

Advertisement

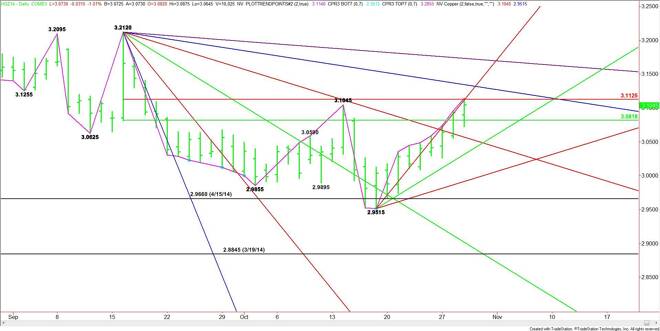

Comex High Grade Copper Futures (HG) Technical Analysis – October 30, 2014 Forecast

By:

News broke yesterday of a big buyer of copper at the LME as December Comex Copper futures broke through the previous main top at 3.1045 while testing the

News broke yesterday of a big buyer of copper at the LME as December Comex Copper futures broke through the previous main top at 3.1045 while testing the Fibonacci level at 3.1125.

A sustained move through 3.1125 could trigger a rally into a resistance cluster at 3.1315 to 3.1320. This is the key area to watch today because the market will either bounce off this level or blow through it to 3.1720.

If there is no follow-through buying today then look for the Fibonacci level at 3.1125 to become the new resistance. This could trigger a move into the 50% level at 3.0820.

The daily chart opens up under 3.0820 with the uptrending angle at 3.0415 another target.

Although the main trend turned up on Wednesday, copper starts the session nine days up from the 2.9515 bottom. Typically, corrections start 7 to 10 days from a bottom so don’t be surprised if there is a pull-back into a value area.

Look for a neutral tone between 3.0820 and 3.1125. A bullish tone will develop on a sustained move over 3.1125. Selling pressure is likely to emerge if 3.0820 is taken out with conviction.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement