Advertisement

Advertisement

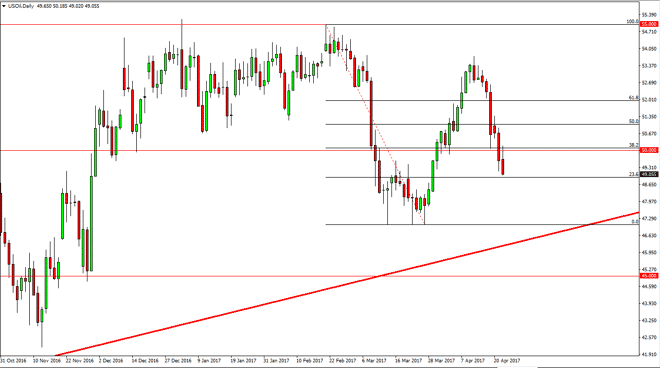

Crude Oil Forecast April 25, 2017, Technical Analysis

Updated: Apr 25, 2017, 03:41 GMT+00:00

WTI Crude Oil The WTI Crude Oil market initially tried to rally during the day on Monday but found the $50 level to be far too resistive. We turned around

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day on Monday but found the $50 level to be far too resistive. We turned around and fell significantly, reaching towards the $49 level. Currently, I believe that hedge funds are starting to step away from the oil markets, and that every time we rally it is going to play out as a nice selling opportunity as oil markets are dealing with massive oversupply. OPEC production cuts will have little effect longer-term in my estimation, so I believe that we are finally starting to see fundamentals work back into the markets again. I believe the market is going to go looking for the $47 level underneath, but we could get a rally from time to time to pick up more value for the sellers.

Crude Oil Video 25.4.17

Brent

Brent markets also tried to rally but found the $52.50 level to be far too resistive. We broke below the $52 level rather easily, and that suggests that we will go looking for the $50 level next. By doing so, I believe that this market will continue to offer selling opportunities on bounces. I think that the $50 level will be rather supportive, so it may take a while to break down through there. Once we do though, that should bring in a fresh round of selling in a market that suddenly looks very bearish. As hedge funds step away from the oil markets, we should continue to see selling going forward.

I have no interest in buying this market, at least not until we break above the $53.50 level, which of course is the bottom of the previous consolidation area. That should be resistance now, so if we can clear that it would show significant strength in a market. Ultimately, this market looks as if we are going to reach towards the $50 level underneath, and then perhaps even lower than that. I think that the oil market is going to continue to be very dangerous, but given enough time we should continue to see bearish pressure.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement