Advertisement

Advertisement

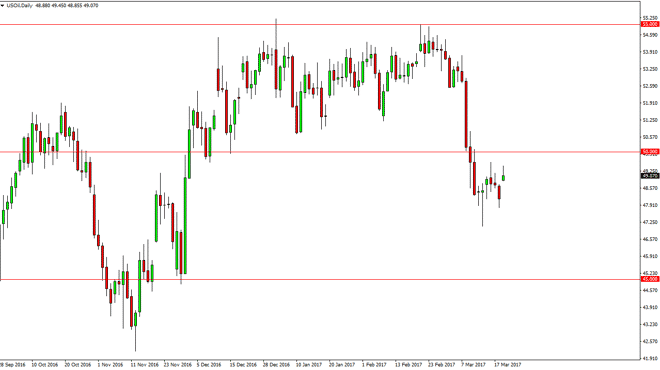

Crude Oil Forecast March 22, 2017, Technical Analysis

Updated: Mar 22, 2017, 04:36 GMT+00:00

WTI Crude Oil The WTI Crude Oil market tried to rally during the day on Tuesday, and even gapped higher at the open. However, I think that it is only a

WTI Crude Oil

The WTI Crude Oil market tried to rally during the day on Tuesday, and even gapped higher at the open. However, I think that it is only a matter of time before the sellers get involved as the oversupply continues to be an issue. However, today is the Crude Oil Inventories announcement, and that of course can cause quite a bit of volatility. I think that the $50 level above will continue to be massively resistive, and essentially the “ceiling” in this market. After all, there is so much in the way of oversupply and the inability of OPEC to clampdown on that supply should continue to keep markets relatively negative. Quite frankly, if we rally after the announcement, I’m looking for signs of exhaustion to start selling.

Oil Forecast Video 22.3.17

Brent

Brent markets also rally during the day but gave back quite a bit of the gains. By forming a bit of a shooting star, it suggests that the market is going to reach towards the $50 level next. Obviously, today is a big day and the short-term, but longer-term I still think that there is so much in the way of bearish pressure that this market has nowhere to go but down longer term. A breakdown below the $50 level would be massively negative, and should send this market looking for the $47 level. Rallies at this point will probably struggle right around the $53 level, which is a massive level previously as far as support was concerned. That should now be resistance, and we should continue to find interest there.

Demand is not as strong as it needs to be, so therefore I look at rallies as continuing opportunities to start selling a market that should be much lower. Longer-term, I currently have a target of $44, which was the previous lows during November of last year. Ultimately, I think we can break down below there, but it is going to take a significant amount of bearish pressure and of course selling going forward. I have no interest in buying this market.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement