Advertisement

Advertisement

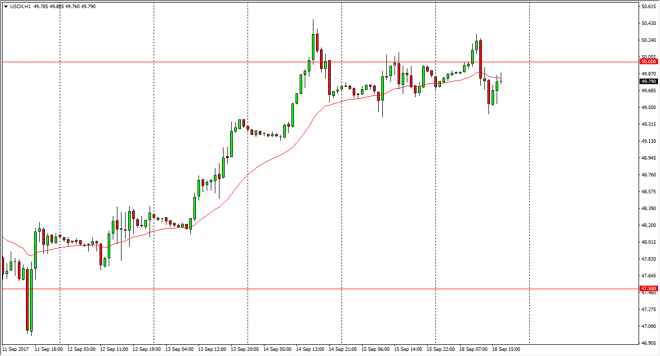

Crude Oil Forecast September 19, 2017, Technical Analysis

Updated: Sep 19, 2017, 05:54 GMT+00:00

WTI Crude Oil The WTI Crude Oil market initially rally during the day on Monday, but ran into a significant amount of resistance above the $50 level.

WTI Crude Oil

The WTI Crude Oil market initially rally during the day on Monday, but ran into a significant amount of resistance above the $50 level. Because of this, we dropped below that psychologically important level, but I currently see this is a consolidated market. I think that the market is can continue to bounce around the $50 level, as we don’t really know where to go next. If we were to break down below the $49.50 level, I think that the market will probably drop towards the $48.50 level. Alternately, if we break above the $50.50 level, the market should then go to the $51 handle next. I expect a lot of noise in this market over the next several sessions. Because of this, you may be best served stepping away, or perhaps trading options so that you can limit your risk right away.

Crude Oil Video 19.9.17

Brent

If there’s a clue in the oil market, it’s probably in the Brent market. The reason I say this is that the WTI and the Brent market tends to move congruently. The Brent market seems to be very supportive in this general vicinity, with $55 being a focal point. I believe that this market will probably rally, and that probably should keep the WTI market somewhat afloat. Ultimately, if we break down below the $55 level underneath, then we probably go lower, perhaps reaching towards $54. In the meantime, I would expect that this market is more likely to reach towards the $56 level above, and a break above there should send this market towards the $57.50 level. Quite a bit of volatility can be expected in this market, but I think that Brent is probably going to lead the way for petroleum markets in general.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement