Advertisement

Advertisement

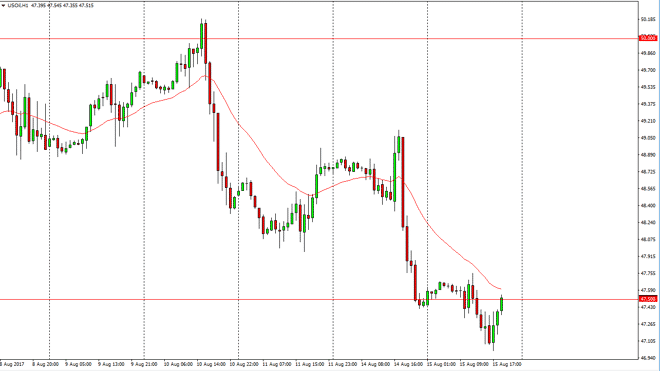

Crude Oil Price Forecast August 16, 2017, Technical Analysis

Updated: Aug 16, 2017, 08:36 GMT+00:00

WTI Crude Oil The WTI Crude Oil market broke down a bit more during the day on Tuesday, after the massive slaughter a price on Monday. Ultimately, the

WTI Crude Oil

The WTI Crude Oil market broke down a bit more during the day on Tuesday, after the massive slaughter a price on Monday. Ultimately, the $47.50 level continues to be of great interest, and I believe that as we have the Crude Oil Inventories announcement coming out today, will be one of the most important levels to pay attention to. I think that if we continue to see bearish pressure all, the market should then break down below the $47 handle. At that point, the market should go much lower. However, if we can break above the $48 level, I would be very bullish. At least for the short term I would. However, I think that longer-term we still have a lot of bearish pressure in this market but I recognize that we are bit oversold in the short term.

Oil Forecast Video 16.8.17

Brent

The Brent market fell slightly during the day as well, testing the vitally important $50 level. That is a psychologically important number, so if we can break down below there I think that the market could continue to go much lower, probably to the $48 level next. Anytime that we rally from here, I would look to sell, and have no interest in trying to pick up the Brent market, unless of course the inventory number changes the complete outlook of the market, which I see as being very unlikely. The gasoline inventories in the United States continue to be flat, and that does not bode well for demand going forward. I think it’s only a matter of time before the sellers return anyway, so quite frankly I would love to see a bounce that I can start selling at higher levels, even if I will have to wait a few days to do so.

Click here is you wish to join the prestigious club of Forex traders

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement