Advertisement

Advertisement

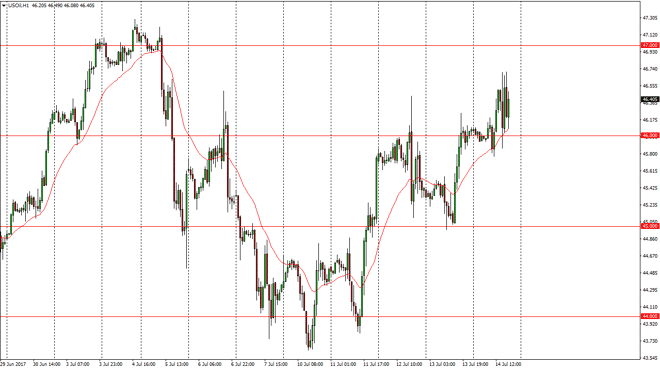

Crude Oil Price Forecast July 17, 2017, Technical Analysis

Updated: Jul 15, 2017, 07:12 GMT+00:00

WTI Crude Oil The WTI Crude Oil market went sideways initially during the day on Friday, but then shot towards the $46.60 level, only to pull back again,

WTI Crude Oil

The WTI Crude Oil market went sideways initially during the day on Friday, but then shot towards the $46.60 level, only to pull back again, and then to bounce yet again. This is a market that continues to show a lot of volatility but I think that the $47 level above is the next barrier that the market is going to have to deal with. And exhaustive candle in that area is a selling opportunity, so that’s what I’m waiting on. Even if we can break above the $47 level, I still am waiting for exhaustion to sell as the market has been very negative for could reason, as the oversupply of oil continues. Quite frankly, OPEC has lost control of the market in general.

Crude Oil Inventories Video 17.7.17

Brent

Brent markets went sideways initially during the day but then exploded just as the WTI crude oil market did, as we rallied, pulled back, and then rallied again. I believe that the $49 level begins a massive barrier of resistance that extends to the $50 handle. Because of this, it’s only a matter of time before we get and exhaustive candle that I can sell. I have no interest in buying the markets, and I believe that these rallies are simply short covering rallies, as markets had become unbalanced. Ultimately, the oversupply of crude oil continues to be a massive issue in this market, and something that I do not think is going to go away anytime soon. In fact, I expect to see much lower pricing given enough time. Rallies are to be sold going forward from what I see.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement