Advertisement

Advertisement

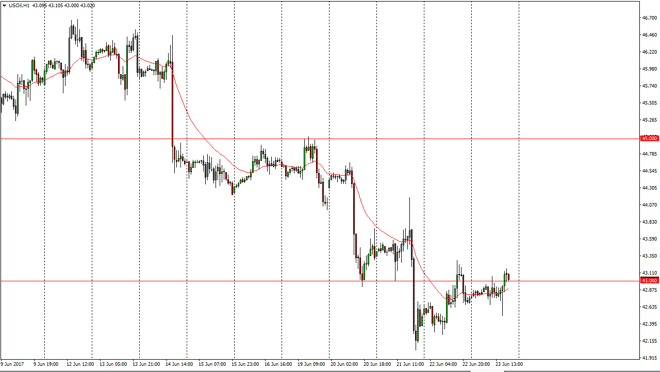

Crude Oil Price Forecast June 26, 2017, Technical Analysis

Updated: Jun 24, 2017, 05:12 GMT+00:00

WTI Crude Oil The WTI Crude Oil market went sideways on Friday, but eventually found enough support to break above $43. However, as I continue to watch

WTI Crude Oil

The WTI Crude Oil market went sideways on Friday, but eventually found enough support to break above $43. However, as I continue to watch the market during the day, looks as if we are getting ready to roll over yet again. It looks as if the market is attracted to the $43 level in general, and I think that selling off is probably what we are about to see again. There is a huge oversupply of crude oil out there, and that should continue to work against the value of WTI going forward. Even if we did rally from here, I would simply look at this is an opportunity to take advantage of rallies and push lower on the longer-term trend. I have no interest in buying this market in the near term.

Crude Oil Inventories Video 26.6.17

Brent

Brent markets went sideways for most of the day, and then drop down to the $45 level. That area offered enough support, and we turned around to rally towards the $45.70 level. We pull back from there, and it looks likely that the market continues to be volatile but I think given enough time we should have and I selling opportunity. This would be especially true near the $46 handle. A breakdown below the $45 level would send this market to much lower levels, as we most certainly have a serious problem with demand.

I am more than willing to short this market every time it rallies and show signs of exhaustion, as the US dollar has been reasonably strong and of course there has been a major problem when it comes to economies around the world, so having said that I am bearish and will continue to be as the oil markets have been so negative.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement