Advertisement

Advertisement

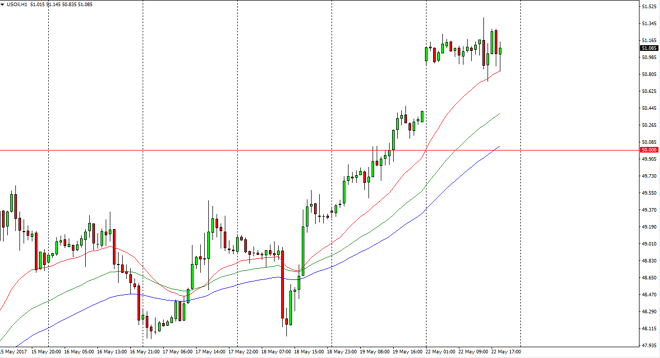

Crude Oil Price Forecast May 23, 2017, Technical Analysis

Updated: May 23, 2017, 06:06 GMT+00:00

WTI Crude Oil The WTI Crude Oil market gapped higher at the open on Monday, as word got out that the Saudi oil minister suggested that most OPEC members

WTI Crude Oil

The WTI Crude Oil market gapped higher at the open on Monday, as word got out that the Saudi oil minister suggested that most OPEC members are already agreeing to extend the production cuts, and some are even talking about deepening them. This of course is very bullish for oil, and therefore we seen a nice pop higher. The market has been consolidating just above the $51 level, so I think it’s only a matter of time before the buyers return. We could go as high as $52.50, and then $55 after that. It should be noted that we have not exploded to the upside, but certainly there seems to be a lot of bullish pressure underneath so if you’re going to be involved, at this point in time the only thing you can do is buy. Selling certainly is not an option as the gap should offer plenty of support.

Crude Oil Video 23.5.17

Brent

Brent markets also gapped higher, but unlike the WTI grade, we actually filled the gap in this market. By doing so, we should see buyers jumping into this market sooner rather than later. The $55 level above will be the first target, and we will have to see how the market reacts to that large, round, psychologically significant number before putting any serious money to work. In the meantime, short-term buying opportunities will more than likely persist, with a significant amount of support near the $53.75 handle.

Brent will be directly affected by what goes on in Saudi Arabia, so it will be interesting to see what happens next. Ultimately, I think that the short-term is going to remain bullish for crude oil, but longer-term we could have bigger structural issues to deal with. Either way, it’s going to be choppy.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement