Advertisement

Advertisement

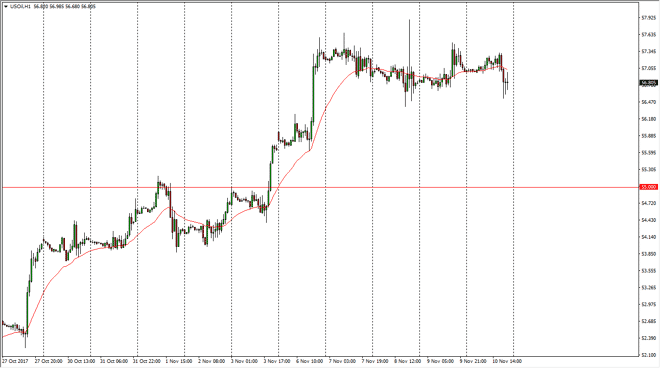

Crude Oil Price Forecast November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:09 GMT+00:00

WTI Crude Oil The WTI Crude Oil market did very little during the day on Friday, as we continue to see the market hover around the $57 region. The market

WTI Crude Oil

The WTI Crude Oil market did very little during the day on Friday, as we continue to see the market hover around the $57 region. The market is a bit overextended, so I think we are taking a bit of a breather so that we can continue to go higher. I also recognize that the $55 level underneath should be the “floor” in the market, so pullbacks should be thought of as potential buying opportunities. The $60 level above is the target for me, but I think it will take a while to get there. Buying on the dips continues to be the way to go going forward from what I see, and I’m not interested in shorting this market until we get well below the $55 level. I think that the oil market will continue to find buyers and the short-term, but I also recognize that the $60 level could be far too much in the way of resistance.

Crude Oil Inventories Video 13.11.17

Brent

Brent markets went sideways as well, chopping around and the $63.50 level. I believe that the $65 level above should be resistance, and I think that the market should continue to be resisted at that area. After all, we have a significant amount of overextension in this market, and I think that the market will see a lot of sellers in that region as when the price of oil spikes, we should see more rigs in the United States, Canada, and the Caribbean. Overall, I think that it’s likely that the markets will continue to be volatile, but given enough time I think that the supply and demand and balance comes back into focus, and we see the market drop a bit. Short-term though, it certainly looks as if the buyers are in control.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement