Advertisement

Advertisement

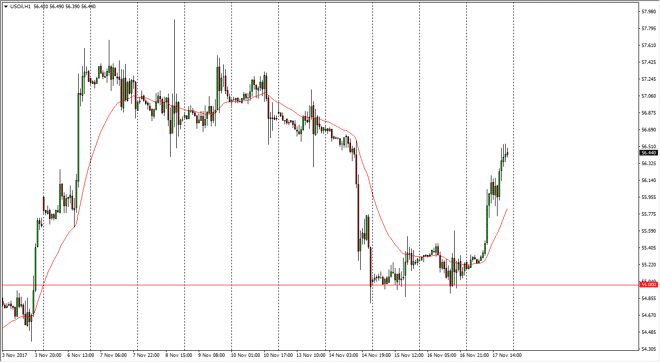

Crude Oil Price Forecast November 20, 2017, Technical Analysis

Updated: Nov 18, 2017, 12:29 GMT+00:00

WTI Crude Oil The WTI Crude Oil market exploded to the upside during the Friday session, reaching towards the $56.50 level. Is an area that was previous

WTI Crude Oil

The WTI Crude Oil market exploded to the upside during the Friday session, reaching towards the $56.50 level. Is an area that was previous support, and now looks likely to be resistance, least in the short term. I suspect that we are going to roll over a little bit, but should find plenty of buying pressure underneath. The $55 level underneath should be support, as it has been recently. I believe that the market is ready to go higher, and the weekly chart looks very bullish as it has formed a hammer. That’s a very bullish sign, and I think that we should continue the run to the upside, unless we somehow break down below the $55 level, which at that point I think the market would come undone. I do believe that eventually we get sellers coming into the market, but right now it continues to be a “buy on the dips” scenario.

Crude Oil Inventories Video 20.11.17

Brent

The brand market exploded to the upside as well, reaching towards the $63 handle above, where we could see a bit of resistance. That had been support, so it should now find plenty of sellers. I believe that the market should roll over from here, perhaps reaching down to the $62 handle. In general, I think that the US dollar weakening should help as well, but we have a lot of noise and I think that the hammer on the weekly chart suggests that we are going to continue to find buyers, and if we don’t make a “lower low”, or breakdown below the $60 level, I think we continue to buy the dips, in short bursts. Longer-term, I believe that the $65 level above is massive resistance, and essentially is going to cause a lot of issues.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement