Advertisement

Advertisement

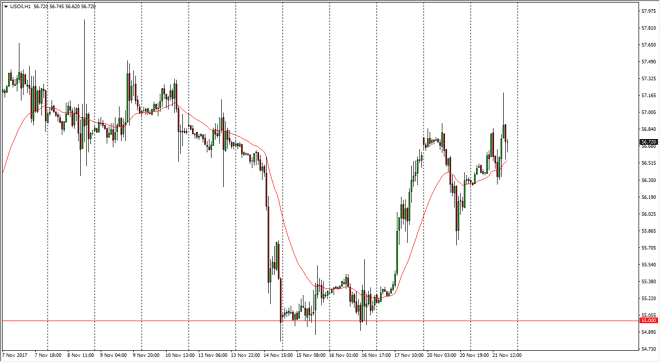

Crude Oil Price Forecast November 22, 2017, Technical Analysis

Updated: Nov 22, 2017, 05:19 GMT+00:00

WTI Crude Oil The WTI Crude Oil market rallied significantly during the day on Tuesday, but in a very volatile manner. Because of this, I think it’s going

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the day on Tuesday, but in a very volatile manner. Because of this, I think it’s going to continue to be a difficult to deal with this market with large amounts of money. I believe that the $57 level above could offer a bit of resistance, but I think we are going to try to break out to the upside. If we do pull back, there should be plenty of support between here and $55, so it’s not until we break down below that level that I’m willing to sell this market. It is simply a “buy on the dips” market, and I will treat it as such. I think that if we can clear the $58 level, the market is very likely to go to $60 at that point, which of course is a structurally and psychologically significant level.

Oil Forecast Video 22.11.17

Brent

Brent markets were also very volatile during the trading session, testing the $62.85 level, before pulling back. The market looks likely to continue to try to grind towards the $64 level above, which was a significant level of resistance. I think that we will continue to see a lot of noise in this market over the next several sessions, and I believe that the $61 level underneath is essentially the support that the buyers are counting on. If we break down below the $60 level, I would be a seller but until then I think we are more likely to find buyers jumping into this market on short-term pullbacks. Longer-term, I think that the $65 level above is going to be a bit of a ceiling. However, if we were to break below $60, I would be more than willing to start selling as it would be a very negative sign.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement