Advertisement

Advertisement

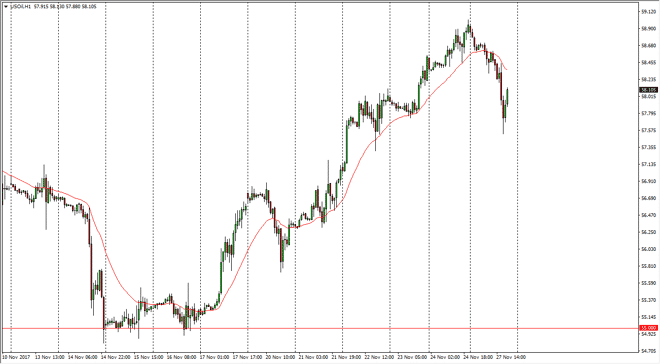

Crude Oil Price Forecast November 28, 2017, Technical Analysis

Updated: Nov 28, 2017, 05:27 GMT+00:00

WTI Crude Oil The WTI Crude Oil market fell significantly during the trading session on Monday, reaching as low as $57.50. We did bounce from there

WTI Crude Oil

The WTI Crude Oil market fell significantly during the trading session on Monday, reaching as low as $57.50. We did bounce from there though, and reached towards the $58 level. A break above there should send this market to the $59 level again, and the pullback, although rapid, has been necessary and well needed. I believe that the market is still looking to reach the $60 handle above, and even though higher crude oil prices will attract more American drillers, I think that $60 is too obvious of a target for buyers to ignore. If we break down below the lows of the session, we could drop down to the $56.50 level. With this type of volatility though, I think it’s going to continue to be a short-term traders type of situation.

Crude Oil Video 28.11.17

Brent

Brent markets fell initially during the trading session on Monday as well, testing the $63 handle. We found enough support there to turn around and bounce again, and I think we are going to reach towards the $64 level again. The $64 level above is resistance, and I think if we can break above there, the market should continue to go higher, perhaps reaching towards the next obvious target: $65. I think that area will be even more resistive, so it’s likely that it will take a significant amount of momentum building to get above there. In the meantime, I believe that this will be a lot of short-term “buy on the dips” mentality to try to build up the necessary momentum and wherewithal to break out. If we were to break down below the $62.50 level, I think at that point we could continue to struggle. Either way, volatility is something I think you can probably count on.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement