Advertisement

Advertisement

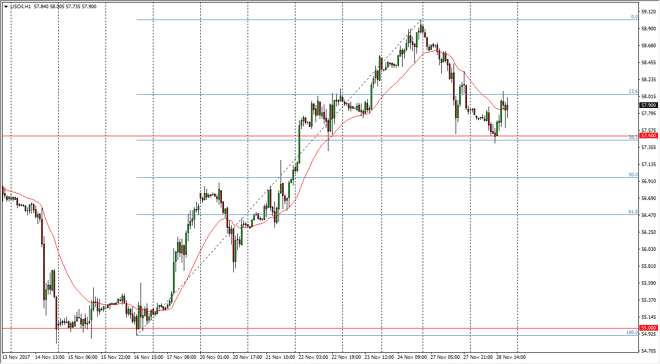

Crude Oil Price Forecast November 29, 2017, Technical Analysis

Updated: Nov 29, 2017, 09:41 GMT+00:00

WTI Crude Oil The WTI Crude Oil market initially drifted lower during the trading session on Tuesday, testing the $57.50 level for support, and finding

WTI Crude Oil

The WTI Crude Oil market initially drifted lower during the trading session on Tuesday, testing the $57.50 level for support, and finding it. It is also the 38.2% Fibonacci retracement level, an area that of course attract a lot of attention, and has been support in the past. I think given enough time, the market will try to break out to the upside, clearing the $58 level and try to go towards the $59 level after that. Longer-term, I anticipate that the $60 level will be targeted as it is a large target. Ultimately, even if we do break down from here, I suspect that the $57 level will also offer a certain amount of support and a significant buying opportunity as well.

Oil Forecast Video 29.11.17

Brent

Brent markets continue to chop around, with the $63 level offering support, and the $64 level above offering resistance. If we can break above the $64 level, the market then goes to the $65 level after that. Alternately, a breakdown below the $63 level should send this market down to the $62 level next. Crude oil markets continue to be very noisy, and with today being the crude oil inventory announcement, it’s likely that we will get a certain amount of volatility. Longer-term, I believe that the $65 level above should be the overall target as it is such a large number. Regardless, expect that there is a lot of buying opportunities going forward, unless of course the inventory number comes out extraordinarily bearish. I believe that any type of knee-jerk reaction is probably a nice opportunity to the upside if the number shocks. In general, I believe in buying but I also recognize that today could be very noisy. Also, you should keep an eye on the US dollar, as this market tends to have an inverse correlation.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement