Advertisement

Advertisement

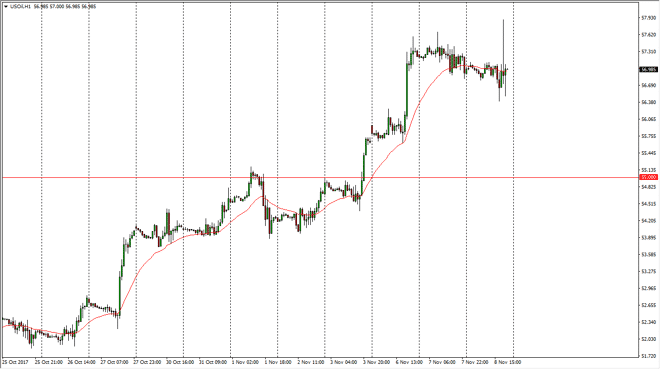

Crude Oil Price Forecast November 9, 2017, Technical Analysis

Updated: Nov 9, 2017, 05:22 GMT+00:00

WTI Crude Oil The WTI Crude Oil market tried to rally during the day on Wednesday, but got be back at the $58 level. I think that we are going to drift a

WTI Crude Oil

The WTI Crude Oil market tried to rally during the day on Wednesday, but got be back at the $58 level. I think that we are going to drift a little bit lower from here, but I also recognize her should be a bit of a floor in the market near the $55 level. This pullback should be a buying opportunity, so if you are looking towards the longer-term move, you are probably best suited to be patient and wait for a supportive candle at lower levels, especially near the $55 level. Ultimately, this is a market that has been very bullish in the short term, and I think that should continue to be the case, at least until we reach the $60 level where I would anticipate much more resistance. However, if we were to break down below the $55 level, I think at that point we could roll over little bit farther.

Crude Oil Price Forecast Video 09.11.17

Brent

Brent markets of course mood very much the same way during the day, and I think that the market will probably reach down to the $60 handle. If we rally from here, I think that the $65 level above is massively resistive, and I think that it’s only a matter of time before we try to get there. This is a market that is a very difficult, at least for the longer-term trader. The short-term trader looks very likely to favor dips as buying opportunities, and I have no interest in shorting. If we break down below the $60 level, that changes everything for me and I would then become a seller. Overall, I think volatility continues, but I think that the buyers will more than likely pick up any drift lower that we are about to see.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement