Advertisement

Advertisement

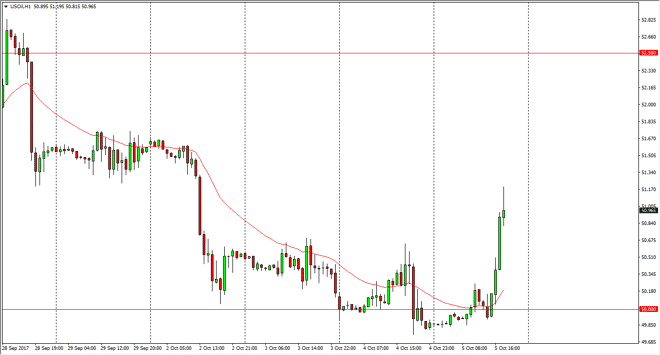

Crude Oil Price Forecast October 6, 2017, Technical Analysis

Updated: Oct 6, 2017, 06:06 GMT+00:00

WTI Crude Oil The WTI Crude Oil market shot straight up in the air during the session on Thursday, testing the $51 level. It looks likely that there is a

WTI Crude Oil

The WTI Crude Oil market shot straight up in the air during the session on Thursday, testing the $51 level. It looks likely that there is a little bit of resistance above, especially as we get closer to the $51.50 level. With the jobs number coming out today, I think you can expect a certain amount of volatility. That volatility should give us an opportunity to trade this market again, and I think that we may be getting a bit exhausted. I would be surprised if the market broke above the $52 level, so given enough time I may be looking for an opportunity to short this market on signs of exhaustion. However, I think it’s probably best to wait for the jobs number to come out first before putting any money to work as it can have a massive influence on the US dollar.

Crude Oil Forecast Video 06.10.17

Brent

Brent markets also rally, but are also testing resistance above, especially near the $57.50 level as it is a gap lower. I think some type of exhaustive candle is reason enough to start shorting, in a market that has over done itself lately. I also believe that there is a massive amount of oversupply in the market, and eventually that will come back into focus. With this, I am a seller of exhaustion, I think it’s too late to start buying. The $58 level above being broken to the upside should send this market to the upside, which would be a very bullish sign. However, I think that rolling over is a good opportunity to make money in a market that continues to fall apart longer-term every time we get a significant amount of buying pressure. The $55 level below is massively supportive.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement