Advertisement

Advertisement

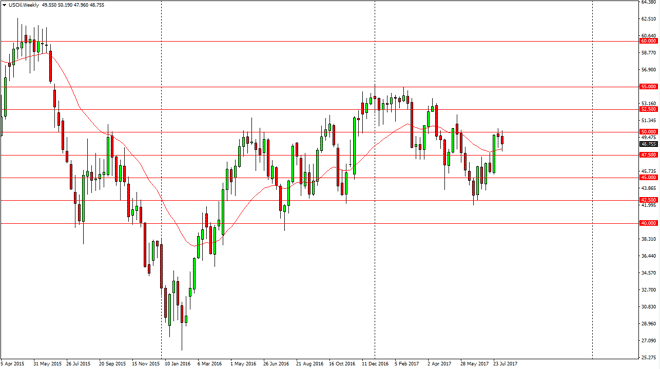

Crude Oil Price Forecast for the Week of August 14, 2017, Technical Analysis

Published: Aug 12, 2017, 04:33 GMT+00:00

WTI Crude Oil The WTI Crude Oil market continue to go back and forth during the course of the week, testing the $47.50 level on the bottom, and the $50

WTI Crude Oil

The WTI Crude Oil market continue to go back and forth during the course of the week, testing the $47.50 level on the bottom, and the $50 level on the top. The market should continue to find quite a bit of choppiness in this area, but when I’ve noticed that the market did was breakdown below the bottom of a hammer for the previous week. A breakdown below the $47.50 level should send this market much lower, reaching towards the $45 level and then the $42.50 level after that. If we managed to break above the $50 level, then I think that the market can continue to go higher. However, the market in general looks like it’s trying to roll over, so I do favor selling opportunities if they present themselves.

Brent

Brent markets went back and forth during the day, eventually forming a shooting star. The previous week of course is a hammer, so this shows quite a bit of choppy and volatile conditions. If we can break down below the bottom of the shooting star, and more importantly the hammer from the week before, we could see this market test the $50 level. A breakdown below there could send this market as low as $45 over the next several weeks. Alternately, if we break above the top of the shooting star from this past week, I believe that the market will probably go towards the $55 level, and possibly even $57. There’s a lot of noise in the market right now, and the US dollar course will have its influence on the market as per usual. The higher the dollar goes, typically the lower oil goes and vice versa. Ultimately, I expect a lot of choppiness.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement