Advertisement

Advertisement

Crude Oil Price forecast for the week of January 8, 2018, Technical Analysis

Updated: Jan 6, 2018, 05:57 GMT+00:00

The crude oil markets have rallied again during this past week, as we continue to see buyers jump into the oil markets based upon tensions in the Middle East, and perhaps a renewed sense of demand as the US and global economies strengthen.

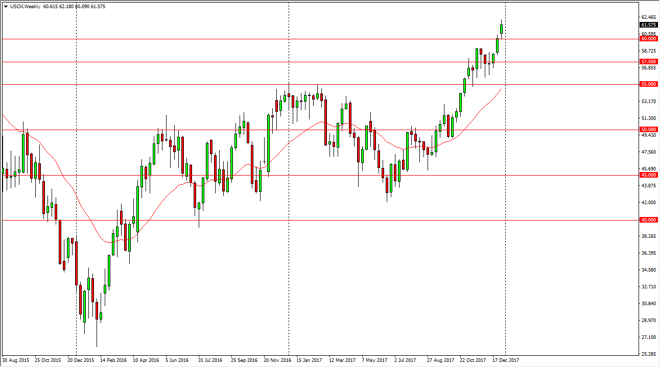

WTI Crude Oil

The WTI Crude Oil market gapped higher at the open on Monday, pulled back later in the week, but then rallied significantly. We have broken higher yet again, and it now looks likely that the market is going to continue to go towards the $62.50 level, and then the $65 level after that. I think the $65 level will of course offer a bit of resistance, so I don’t think we can break through their right away, but I do think that the market is wanting to test that psychologically important area. Underneath, I see significant support at not only the $60 level, but the $57.50 level as well.

WTI Video 08.01.18

Brent

Brent markets initially gapped higher at the open on Monday, pulled back below there, but found enough support to continue to go much higher. I think that the $70 level will be targeted, and that the $65 level is massively supportive. The $70 level of course is a very psychologically important level, as the market should respect that level and of course be tempted to test it. If we were to break above the $70 handle, then of course Brent can explode even further. We are bit overextended though, so I think it’s going to take a significant amount of work to break above the $70 level, unless of course some type of tension flares up in the Middle East yet again. The protest in Iran of course have some oil traders concerned, but in the end demand will be much more important to focus on.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement