Advertisement

Advertisement

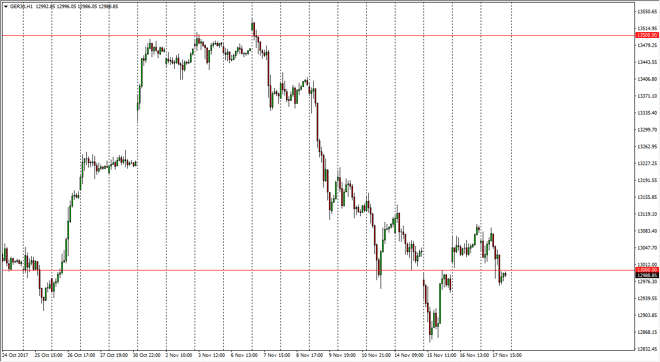

DAX Index Forecast November 20, 2017, Technical Analysis

Published: Nov 18, 2017, 05:37 GMT+00:00

The German index had a negative session on Friday, gapping lower at the open and then slicing below the €13,000 level. Because of this, looks as if we are

The German index had a negative session on Friday, gapping lower at the open and then slicing below the €13,000 level. Because of this, looks as if we are going to try to find support and trying to bounce from here, and therefore I believe that the buyers are looking at this as an opportunity to pick up value. Overall, I remain very bullish of the DAX, and believe that we will continue to see buyers jump in one we are looking at lower pricing like this. I believe that there is significant support down to at least the 12,900 level, so as long as we don’t make a “lower low”, I am comfortable buying these dips. They move above the €13,100 level should send this market looking to much higher levels, and eventually looking to reach the €13,500 level again. The longer-term chart looks healthy as well, and the recent pullback looks to be finding support right where we need to see it if we are to remain bullish.

The EUR/USD pair has been strengthening, and as that can often influence where we go next in the DAX, I believe that we are getting away from the concern of currency headwinds and are starting to focus on the fundamentals of the German index. I believe that this market will continue to do well as it is the leading indicator of European Union strength, and therefore money will flow into the DAX first, and then to the other indices as well. The European Union has been strengthening in general, and concerns about the tax bill not going for Congress very quickly in America continues to have money flowing from left to right at the Atlantic Ocean. Pay attention to US and Japanese equities, if they continue to do well, that should have a knock-on effect in Germany.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement