Advertisement

Advertisement

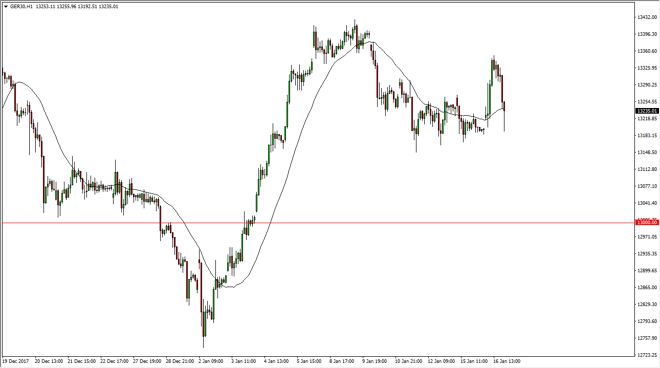

DAX Index Price Forecast January 17, 2018, Technical Analysis

Updated: Jan 17, 2018, 08:11 GMT+00:00

The German index gapped higher at the open on Tuesday, then shot to the upside. However, we turned around to fall just as hard. This looks like a confused and noisy market currently, and I believe that there is more than enough reason to think that it will probably continue.

The German index gapped higher at the open on Tuesday, reaching towards the €350 level after that. However, we turned around from there and broke down rather significantly, reaching down to the €13,200 level underneath. That is an area that is very noisy and could be supportive based upon the support that we have seen over the last several days. If we can break down below there, the market probably goes looking towards the €13,000 level next, which for me is a much more significant level and essentially the “floor” in the market.

A bounce from here should send the market looking towards the €13,350 level, which is the top of the range for the day. If that happens, then we enter consolidation and could go sideways in general. A break above that level of course allows the market to go to the upside, perhaps reaching towards the €15,000 DAX level.

Although I think there is a lot of noise in the market right now, it’s likely that the noise continues to be a minor sideshow, as the longer-term uptrend is the main factor in trading this market. Because of this, I’m not selling into we get below the €13,000 level, and most certainly not until we break down significantly. I’m looking for stability, and of course bounces to take advantage of the market. I think that the market is likely to favor the upside, but we may have gotten a bit ahead of ourselves during the last couple of weeks. Look for value, and then take it.

DAX Video 17.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement