Advertisement

Advertisement

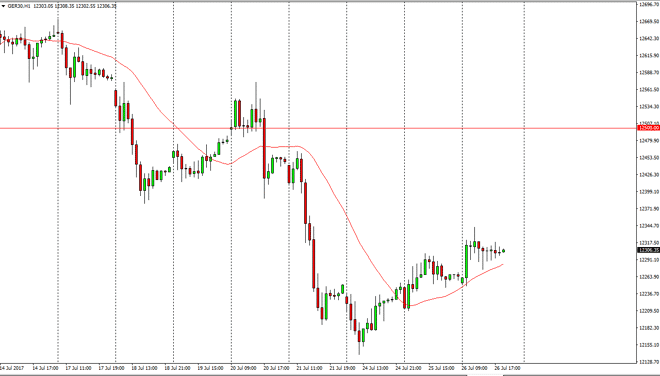

DAX Index Price Forecast July 27, 2017, Technical Analysis

Updated: Jul 27, 2017, 04:42 GMT+00:00

The German index did rally a bit at the open on Wednesday, but then sat still at the €12,300 level. We have recently bounced a bit, and it looks like we

The German index did rally a bit at the open on Wednesday, but then sat still at the €12,300 level. We have recently bounced a bit, and it looks like we are trying to find her footing again. There is a bit of a barrier at the €12,500 level, but if there’s any index that we can imagine breaking to the upside in the European Union, and most certainly is the DAX. It tends to be one of the better moving indices and better followed one, so I think that it’s only a matter of time before the buyers return. I believe that the “floor” in the market is close to the €12,000 level, and that needs to be broken for me to be comfortable shorting. Yes, the DAX has taken a bit of a hit as of late, but a lot of this comes down to currency headwinds more than anything else. They don’t really have much to do with economic earnings.

EUR/USD

The EUR/USD pair continues to be a driver of this market as an expensive Euro weighs upon German exports. However, I think that one of the things that people are overlooking is that the European economic numbers have gotten better as of late. Because of this, it’s likely that the correlation in the currency markets may drop a bit, and that should have this market rebounding. After all, a stronger European economy will help the DAX in the long run. Ultimately, I believe that the market should reach towards the €12,500 level, breaking above the level should then send this market to the €12,750 level, perhaps even €13,000. Selling isn’t a thought until we break down below the €12,000 level, which would have me massively short of this market.

DAX Video 27.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement