Advertisement

Advertisement

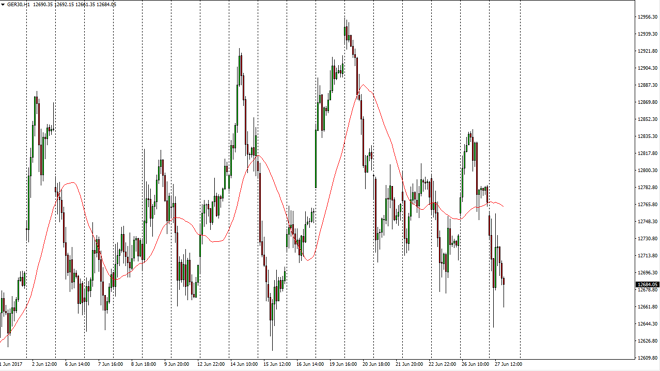

DAX Index Price Forecast June 28, 2017, Technical Analysis

Updated: Jun 28, 2017, 05:48 GMT+00:00

The German index gapped lower at the open on Tuesday, and then drove down to the €12,650 level. The market found a little bit of support in that area, and

The German index gapped lower at the open on Tuesday, and then drove down to the €12,650 level. The market found a little bit of support in that area, and as a result I think that the market will probably try to fill the gap. Longer-term, I do like the DAX in general, as it is one of the more bullish indices longer term. I think that the longer-term uptrend is valid until we break down below the €12,500 level, and then perhaps down to the €12,000 level. I’m looking for some type of bounce to take advantage of, and I believe that we will eventually go to the €13,000 level above, which is my longer-term target anyway. I recognize that there are a lot of headlines coming out of both London and Brussels that will move this market, as we should come to terms with some type of agreement between the United Kingdom and the European Union.

EUR/USD

The EUR/USD pair has a massive influence on this index, but given enough time it has a lot to do with the export market coming out of Germany, but as the EUR moves back and forth, that will either make German exports cheaper or more expensive, and that of course has a knock-on effect in the DAX. I believe that eventually the DAX rises, mainly because I believe that the EUR/USD pair could fall as well, as Mario Draghi continues to talk down the currency. With this in mind, I’m a buyer on signs of support and of course impulsive candles. I think that eventually we will not only reach the 13,000 handle, but we will break well above there and continue to go much higher. The DAX continues to be one of my favorite markets.

DAX Video 28.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement