Advertisement

Advertisement

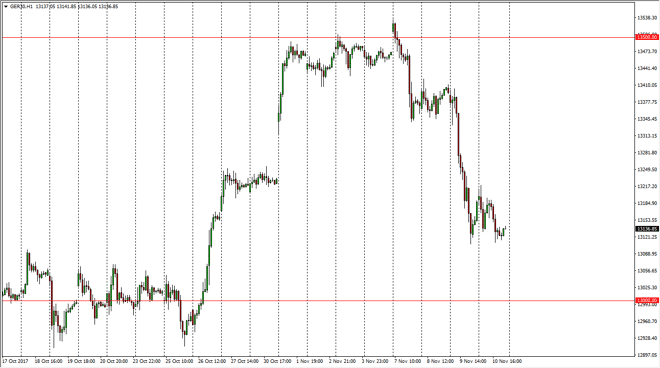

DAX Index Price Forecast November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:09 GMT+00:00

The German index was choppy on Friday, as we continue to see weakness. The market had recently broken down drastically, and then sliced through a gap that

The German index was choppy on Friday, as we continue to see weakness. The market had recently broken down drastically, and then sliced through a gap that should have been very supportive. As we are closing at the very low of the range for the week, I suggest that we are going to continue to see more selling pressure. Because of this, I believe that the next support level based upon charting in order flow should be closer to the €13,000 level. If we can find support there, it should be a nice buying opportunity for short-term traders. However, the weekly chart looks very negative, so I think we may need to break down even further. It’ll be interesting to see how the EUR/USD pair plays out, as it has suddenly turned around and looks healthy. If it rallies enough, that will continue to put bearish pressure on the DAX, as it makes those German exports so expensive.

All things being equal though, I do believe in the longer-term uptrend, so it becomes a question as to whether we can start buying yet? I think 13,000 makes a lot of sense, but if we were to break down below there the next major target is going to be the €12,900 level, that had seen quite a bit of support as well. I don’t have any interest in shorting this market, although traders who are more of the scalping variety may feel comfortable shorting down to the €13,000 handle. That takes a certain amount of dexterity, and of course the ability to watch the charts constantly. For myself, I would rather wait for a major area to start getting involved in again. Until then, I will be on the sidelines and watching.

DAX Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement