Advertisement

Advertisement

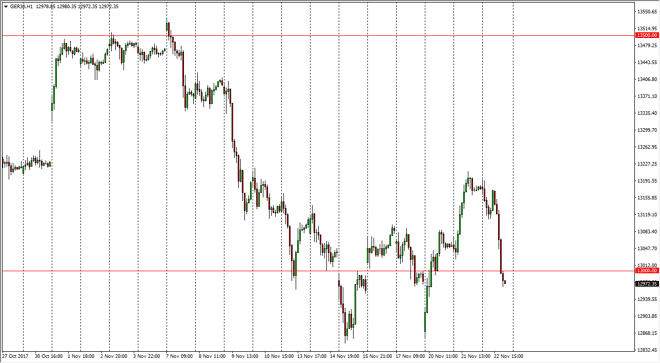

DAX Index Price Forecast November 23, 2017, Technical Analysis

Updated: Nov 23, 2017, 05:02 GMT+00:00

The German index has had a very interesting trading session during the day on Wednesday, as we had initially trying to get back the losses, only to fall

The German index has had a very interesting trading session during the day on Wednesday, as we had initially trying to get back the losses, only to fall yet again. The €13,000 level underneath should continue to be important, and because of this I would not be surprised to see some type of bounce from here, which would be an excellent buying opportunity due to the longer-term charts. However, if we were to break down below the €12,850 level, then I think the DAX would be in a bit of trouble, but we have seen so much in the way of bullish pressure longer-term, it’s likely that we will find buyers looking towards the €13,500 level. The volatility should continue, and quite frankly with the Americans away at Thanksgiving, it’s likely that the DAX will be the biggest game in town for indices traders. Because of this, it’s likely that we could see a bit of volume during the day.

A bounce from here should send the market looking to the €13,200 level, and then eventually the €13,500 level after that. The EUR/USD pair of course has its influence on this market, and as it has risen over the last 24 hours, it sends the DAX lower, as we start to focus on more expensive the German exports. However, it’s very unlikely that comes into play for the longer-term, as we are starting to see the market ignore that occasionally. There are longer-term fundamentals coming out of Germany that could suggest a stronger DAX, but at the moment we are focused on the German government’s inability to form some type of coalition. Ultimately, I believe that structurally we should find buyers, but a breakdown below the €12,850 level could change everything significantly.

DAX Video 23.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement