Advertisement

Advertisement

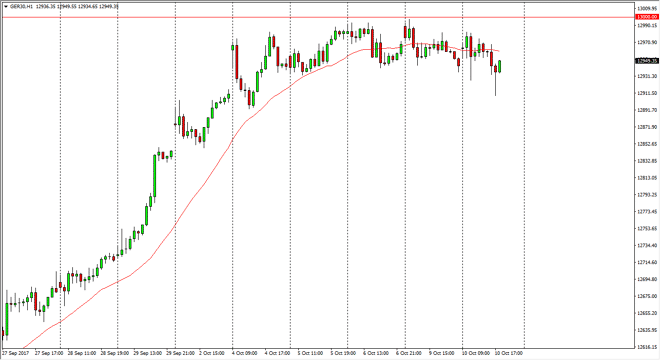

DAX Index Price Forecast October 11, 2017, Technical Analysis

Updated: Oct 11, 2017, 05:27 GMT+00:00

The German index pulled back a bit during the day on Tuesday, as we found support near the €12,900 level. That’s an area where I think we should see

The German index pulled back a bit during the day on Tuesday, as we found support near the €12,900 level. That’s an area where I think we should see buyers jumping back into the market, and then reaching towards the €13,000 handle. I believe the pullbacks will continue to offer opportunities to go long, and if we can break above the €13,000 level, the market should continue to go much higher. I believe in buying dips in this market, and I also believe that eventually we will go towards the €13,500 level. If we can break down below the €12,900 level, the market probably goes down to the €12,800 level underneath. That’s an area that should be supportive, but I cannot help but notice that the 24-hour exponential moving average has flattened out, and that suggests to me that it may take a while to break out to the upside. This is a market that should continue to find buyers, as the German index continues to be one of the leaders of the European Union.

Ultimately, this is a market that continues to lead the European Union to the upside, and is one of the first places that money comes into when it comes to the European Union. Choppiness aside, I still believe in the DAX longer-term, and therefore I don’t have any interest in selling. I believe that the €12,750 level should be a bit of a “floor” in the market, and I think that we will continue to see an extreme amount of resiliency in this market, as we have seen in other stock markets around the world. The DAX is considered to be one of the “safer” stock markets, so it makes sense that it will continue to find levity just below.

DAX Video 11.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement