Advertisement

Advertisement

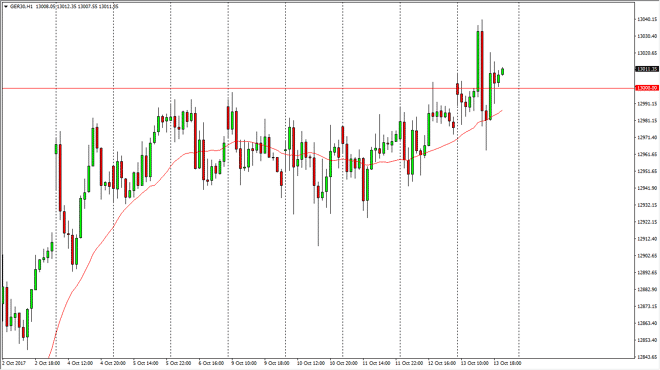

DAX Index Price Forecast October 16, 2017, Technical Analysis

Updated: Oct 14, 2017, 05:30 GMT+00:00

The German index gapped higher at the open on Friday, reaching towards the €13,000 level. We pulled back from there, and then rallied yet again only to

The German index gapped higher at the open on Friday, reaching towards the €13,000 level. We pulled back from there, and then rallied yet again only to pull back and fall back towards the gap. We formed a nice hammer on the hourly chart, and at the 24-hour exponential moving average. Because of this, we rallied above the €13,000 level again, and it now looks as if we are going to continue to strengthen going forward, perhaps reaching towards the €13,100 level next. I don’t have any interest in shorting the DAX, a continues to lead the rest of the European Union higher. Ultimately, the market should continue to be noisy, but certainly supported as the European Union seems to be doing better. The DAX is a bit of a bellwether for the rest of the continent, so if the European Union does well, the DAX does also.

I don’t have any interest in shorting, but I recognize that a move below the €12,900 level would be a very negative sign. Ultimately, if we break down below there I think we could go as low as €12,750 after that. This market continues to show signs of strength going forward, so I don’t think that we are going to be shorting anytime soon, but you should always keep the overall attitude of the European Union in mind when trading the DAX, because this is the first place where people start to put money to work. The impulsivity of the move during the Friday session of course was very impressive, and I believe that a continuation after this type of volatility should be the next leg higher just waiting to happen. Ultimately, the volatility should shakeout the “weak hands”, with a larger core of big-money sitting in the DAX.

DAX Video 16.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement