Advertisement

Advertisement

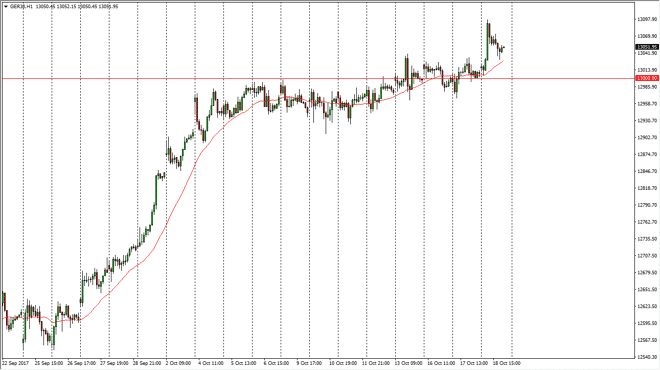

DAX Index Price Forecast October 19, 2017, Technical Analysis

Updated: Oct 19, 2017, 04:53 GMT+00:00

The German index rallied significantly during the trading session on Wednesday, bring boarding off of the €13,000 level, reaching towards the €13,100

The German index rallied significantly during the trading session on Wednesday, bring boarding off of the €13,000 level, reaching towards the €13,100 level, but then pulling back. The pullback has seen buyers come back into the market, so I think that the DAX will continue to see quite a bit of bullish pressure. I think that the €13,000 level offers a bit of a “floor” in the market, as it is a large, round, psychologically important number, which should now offer significant support. It took a while to get above that level, so it makes sense that there is a lot of interest in keeping this market to the upside. Keep in mind that the German index is a proxy for most of the European Union, so therefore if the EU is favored, then people are putting money into the DAX.

In fact, I believe that there is enough support at the €13,000 level to offer a buying opportunity, and I think that the range drops down to the €12,900 level underneath. Ultimately, the market should continue to see buyers on dips, and I think we will go towards the €13,250 handle above. I have no interest in shorting, unless of course we were to break down below the €12,900 level. Below that level, the market probably goes down to the €12,500 level which could offer a short-term selling opportunity. Longer-term, I believe that “buy-and-hold” works as well, so there are a lot of different ways to approach this, but in general I think that the bullish pressure continues to be the one main thing that you should be paying attention to. Even if we do break down, it’s a short-term opportunity at best. Longer-term, the DAX will continue to lead the rest of the European indices higher.

DAX Video 19.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement