Advertisement

Advertisement

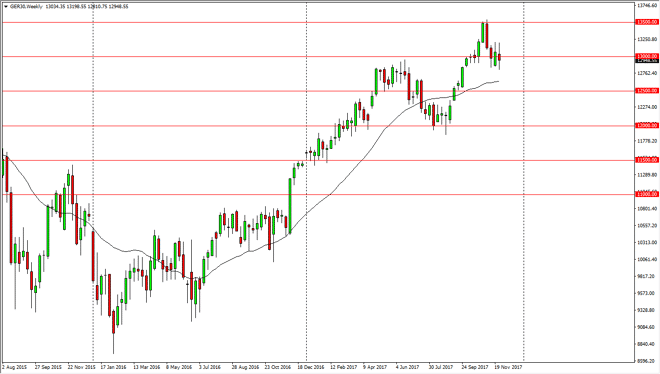

DAX Index Price forecast for the week of December 4, 2017, Technical Analysis

Updated: Dec 2, 2017, 07:44 GMT+00:00

The German index continues to be very noisy, and more importantly: attracted to the €13,000 level. This is a market that seems to be trying to build up a base.

The DAX went back and forth during the course of the week, forming a neutral looking candle at the €13,000 level. This is an area that was previously resistive, and it is now looking to act as support. If we can break above the top of the range for the week, I feel that the DAX at that point will go towards the highs, reaching towards the €13,500 level. Alternately, if we did breakdown below the bottom of the candle for the week, we could go as low as the €12,500 level underneath, which should be supportive. I believe that pullbacks offer value that we can take advantage of, as the market is still in a very bullish uptrend, but it is of course very noisy. This noise is indicative of a market that is trying to find some type of support or perhaps even base to go higher.

In general, I believe that the market will eventually find buyers and go much higher. Ultimately, I think we not only rally from here, I believe that we get above the €13,500 level and go looking towards the €14,000 level next. There is no trade to start shorting this market until we break down below the €12,000 level, which I see the market finding the “floor” in the uptrend. I believe that the market continue to be noisy, but eventually we should find buyers in what is the strongest market in the European Union, and essentially the blue-chip index and most people throw money at first. Be aware of the headwinds of a strengthening euro, but fundamentally Germany is still doing quite well.

DAX Video 04.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement