Advertisement

Advertisement

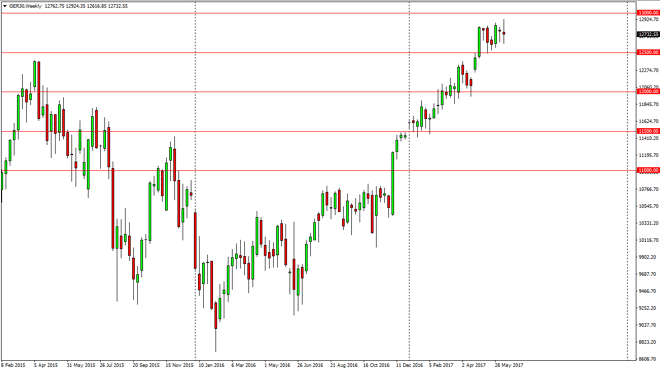

DAX Index Price forecast for the week of June 19, 2017, Technical Analysis

Updated: Jun 17, 2017, 07:15 GMT+00:00

The German index went back and forth during the week, showing significant volatility yet again. The €12,500 level underneath should be supportive, as it

The German index went back and forth during the week, showing significant volatility yet again. The €12,500 level underneath should be supportive, as it was massively resistive. When you look at the bottom of the weekly candles, you can see that the lows are gradually trying to get higher again, so I think that we are building up the upward momentum and pressure to send the market much higher. I think if we can break above the €13,000 level, the market should continue to go much higher and continue the longer-term uptrend. I believe that pullbacks are buying opportunities, and the €12,000 level underneath will be essentially the “bottom” of this market, and I think that the DAX will continue to be the leader when it comes to the European Union indices.

Money goes to Germany first

I believe that money goes to Germany first when it comes to investing in the European Union, and as long as this market rallies, the other indices in the European Union should continue to do very well. The markets look very bullish overall, and I believe that the DAX will be the first one to break out. Because of this, I am very interested in being long the DAX, but position sizing will be very important so that you can hang onto any of the choppiness. After all, you never know how long we are going to consolidate, and therefore it’s difficult to imagine that is going to be easy to deal with, and because of this smaller positions might make more sense until we can get significant bullish pressure. Dips are also value just waiting to happen and what I believe will be a leader going forward.

DAX Video 19.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement