Advertisement

Advertisement

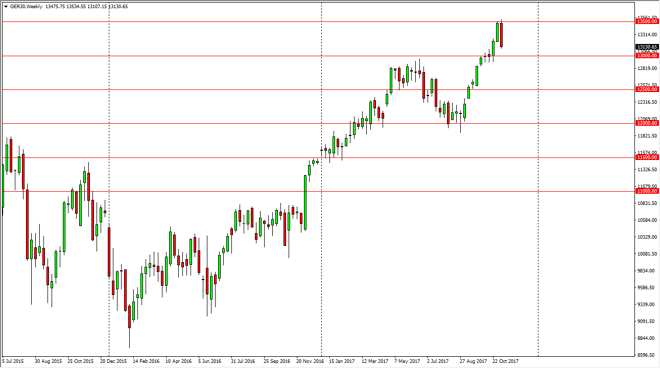

DAX Index Price forecast for the week of November 13, 2017, Technical Analysis

Updated: Nov 11, 2017, 05:12 GMT+00:00

The German index initially tried to break above the €13,500 level, but broke down significantly as we wiped out the gains from the previous week. The very

The German index initially tried to break above the €13,500 level, but broke down significantly as we wiped out the gains from the previous week. The very negative candle of course looks horribly negative, and I believe that the €13,000 level underneath is the first target. That’s an area that looks very likely to be of interest, as we are in a strong uptrend. However, I am not interested in shorting this market out right, I would prefer to see some type of supportive weekly candle that I could start buying. With this, I’m very cautious and I’m not willing to take the long-term tree quite yet. After all, we did close towards the bottom of the range for the week which of course is a negative sign. However, I see so much order flow underneath that it’s only a matter of time before we get involved to the upside again. In fact, I do not believe that the uptrend is over with until we get below the €12,000 level, which is much further below.

Alternately, if we did turn around immediately and break above the €13,500 level, it would be almost impossible to avoid buying this market. I believe the part of the problem with this market is that the EUR/USD pair is starting to show signs of strength again as the US dollar has fallen in general. That makes German exports a bit more expensive, and there does tend to be a bit of a negative correlation between the 2 markets. The noise continues, but it’s obviously a market that should continue to find plenty of reasons to go higher. The DAX of course is the epicenter of EU investing, so if money starts to flow back into Europe, it will certainly flow into the DAX.

DAX Video 13.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement