Advertisement

Advertisement

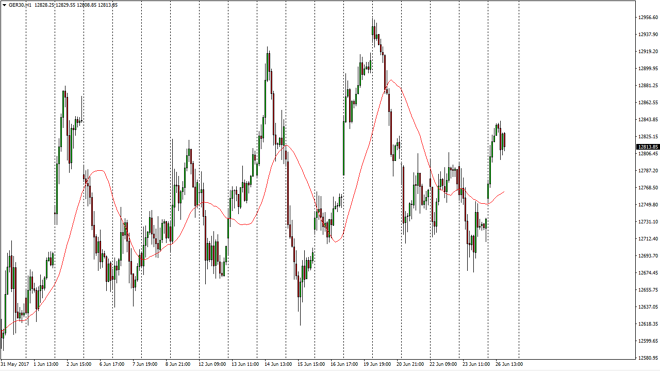

DAX Price Forecast June 27, 2017, Technical Analysis

Updated: Jun 27, 2017, 06:53 GMT+00:00

The German index gapped higher at the open on Monday, and then shot towards the €12,850 level. We pulled back slightly but at the end of the day I think

The German index gapped higher at the open on Monday, and then shot towards the €12,850 level. We pulled back slightly but at the end of the day I think that there is still plenty of bullish pressure underneath the keep this market going higher. The gap at the beginning of the session of course is a very bullish sign in the 24-hour exponential moving average is starting to move to the upside again. Longer-term, this market has been bullish, so I think that the buyers will continue to jump into this market and attempt to push prices much higher. This allows for value hunters to take bits and pieces out of this market, giving us an opportunity to “buy on the dips.” I think that the DAX will continue to be one of the better performers that we follow here at FX Empire, least historically speaking. After all, it is the first place money goes to when coming into the European Union.

Equities on the whole look good

I believe that equities overall look at around the world, and the DAX is just simply an extension of this. I think that if American indices go higher, there’s no reason to think that the DAX won’t. Yes, they move at different speeds sometimes, but quite frankly it’s a “risk on/risk off” type of proposition. I still have a target of €13,000, and I believe that we will reach that level over the next couple of weeks. It is the summertime, so volatility may slow down a bit, but at the end of the summer I fully expect to be above the €13,000 level so I don’t have any interest in selling this market anytime soon, and believe that the DAX should continue to strengthen.

DAX Video 27.6.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement