Advertisement

Advertisement

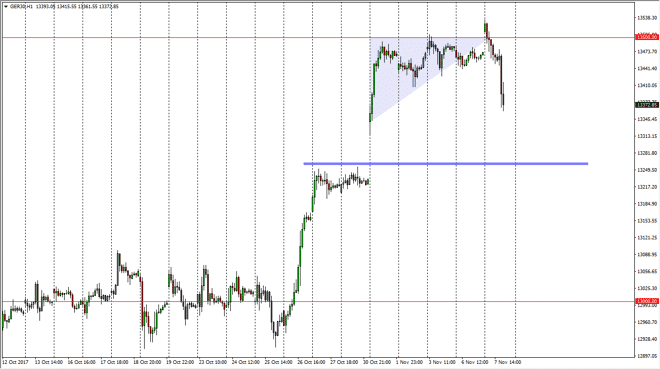

DAX Price Forecast November 8, 2017, Technical Analysis

Updated: Nov 8, 2017, 05:28 GMT+00:00

The German index gapped higher at the open on Tuesday, breaking above the €13,500 level. However, we have fallen rather significantly, and the hourly

The German index gapped higher at the open on Tuesday, breaking above the €13,500 level. However, we have fallen rather significantly, and the hourly chart suddenly looks very ugly. I believe that the gap below will get filled, perhaps reaching down towards the €13,250 handle. I think that the market will find plenty of buyers there, so I’m looking at this as a potential buying opportunity. This will be especially true if the EUR/USD pair continues its drop towards the 1.13 level underneath as I suspect, that should make the German exports cheap enough to attract a lot of buying in the DAX. I think this is a technical move just waiting to happen, so although you could make an argument for shorting the DAX at this level for a short-term trade, I think the more astute trader will be looking for a buying opportunity at lower levels, which is exactly what I’m expecting to do.

Some type of supportive candle or a bounce from the €13,250 level is exactly what I’m looking for, as we would then go back towards the €13,500 level, and eventually break above there again. Perhaps we need to pull back to build up enough momentum to finally break out, which of course is quite common in the technical analysis world. The DAX continues to be the blue-chip index for the European Union, and therefore I look at this as a bet on the EU itself. In general, if we were to break down below the €13,250 level, I would expect even more support and interest at the €13,000 level. In short, I have no interest in selling this market and believe that we do go higher over the longer-term, with €15,000 being a potential target eventually.

DAX Video 08.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement