Advertisement

Advertisement

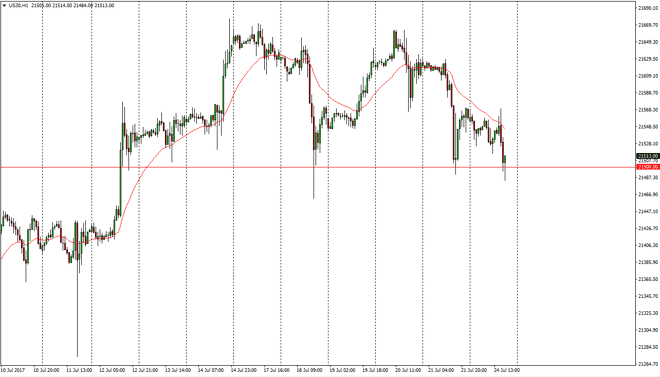

Dow Jones 30 and NASDAQ 100 Forecast July 25, 2017, Technical Analysis

Updated: Jul 25, 2017, 04:15 GMT+00:00

Dow Jones 30 The Dow Jones 30 market sold off initially on Monday, but interestingly enough found enough support at the 21,500 level to turn around and

Dow Jones 30

The Dow Jones 30 market sold off initially on Monday, but interestingly enough found enough support at the 21,500 level to turn around and form a bit of a supportive candle on the hourly chart. I believe we are going to see a lot of bullish pressure in this area, or at least significant support. Because of this, I am a buyer of this market, as I believe we will bounce to the 21,550 handle, and then towards the highs again at the 21,650 level. The Federal Reserve continues to look like it’s becoming a bit more dovish, and the US traders are all over that scenario. Pullbacks should be buying opportunities as long as we can stay above the 21,400 level.

Dow Jones 30 and NASDAQ Index Video 25.7.17

NASDAQ 100

The NASDAQ 100 was actually a bit bullish at the same time as the Dow Jones 30 selling off, and I think that’s the real underlie her of the market. The NASDAQ 100 has lead the way for other US indices, and I think that will continue to be the case. I still have a target of 6000 and the NASDAQ 100 so I believe that there is plenty of value to be had on dips. 5900 should continue to offer support, and quite frankly I have no interest in selling this market if we are still above the 5800 level, which I think we will be for the foreseeable future. Ultimately, I think that the market continues to find buyers as the NASDAQ 100 and technology in general has been a leader in the United States, as well as other stock markets around the world. Dips offer value, and I plan on taking advantage of that going forward. Eventually, I believe that we will break above the 6000 handle.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement