Advertisement

Advertisement

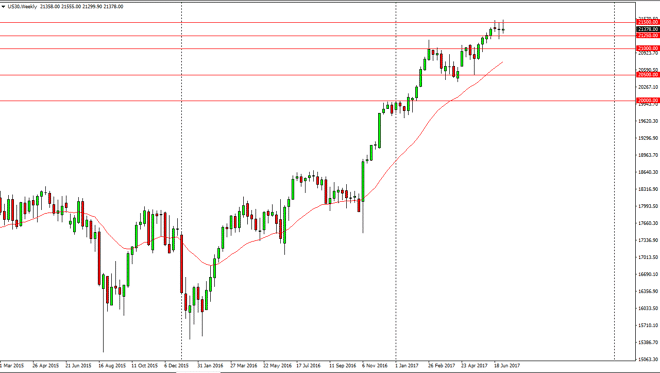

Dow Jones 30 and NASDAQ 100 Forecast for the Week of July 10, 2017, Technical Analysis

Updated: Jul 9, 2017, 07:18 GMT+00:00

Dow Jones 30 The Dow Jones 30 initially tried to rally during the week but found enough resistance near the 21,500 level to turn around and fall

Dow Jones 30

The Dow Jones 30 initially tried to rally during the week but found enough resistance near the 21,500 level to turn around and fall significantly. By the end of the week, we started to form a bit of a shooting star, but that was preceded by a hammer and then another shooting star. There is a significant amount of support near the 21,250 level, so I don’t think that selling is an easy thing to do. It would not surprise me to see a market pull back towards the 21,000 level, where I would expect to see a significant amount of support. Alternately, if we can break above the top of the shooting star from the week, that would be a buying opportunity as well. Ultimately, this is a market that should continue to see buyers as we have been in a strong uptrend.

Dow Jones 30 and NASDAQ Index Video 10.7.17

NASDAQ 100

The NASDAQ 100 has recently sold off, and even has broken below the bottom of an uptrend line. However, the weekly candle that we just formed was a hammer, and that of course is a very bullish sign. If we can break above the 5700 level, I think that the market continues to go the upside, as we consolidate in general, especially sideways over the last several weeks. If we can break above the 5900 level, then we can go test the 6000 level. The 5500-level underneath is massively supportive, and if we were to break down below that, I feel that the market would come unraveled and probably go looking towards the 5250 level after that. The NASDAQ 100 has been very bullish until recently, as it has lead the other US indices higher. Perhaps we are seeing a sector rotation into the Dow Jones 30.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement