Advertisement

Advertisement

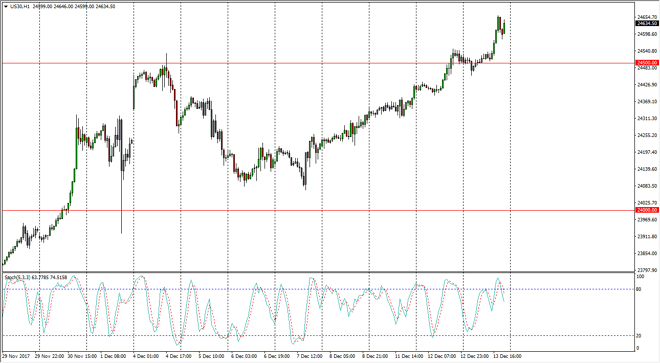

Dow Jones 30 and NASDAQ 100 Price Forecast December 14, 2017, Technical Analysis

Updated: Dec 14, 2017, 06:03 GMT+00:00

The Dow Jones 30 and the NASDAQ 100 both rallied after the interest rate decision on Wednesday, showing signs that the rally is still very much intact.

Dow Jones 30

The Dow Jones 30 had a very bullish session during the day on Wednesday, breaking out to the upside in reaching to fresh, new highs. I think the 24,500-level underneath should be support, and I think that the level is essentially the “floor” in the market. I think that if we get enough of a pullback, there will be plenty of buyers underneath to pick up the perceived value being offered. The market breaking below the 24,500 level would be a very negative sign, and at that point I think it could be in trouble, at least for the short term. Given enough time though, I think that were going to go looking towards the 25,000 handle, although that will probably be a January story.

Dow Jones 30 and NASDAQ Index Video 14.12.17

NASDAQ 100

The NASDAQ 100 also rallied, breaking above the 6400 level. By doing so, it looks likely that the market will go to the 6450 handle, and then potentially the 6500 level above which is a large, round, psychologically significant number. I think that pullbacks offer value, and I believe that the NASDAQ 100 should continue to be a market that although lagging the rest of the United States indices, should be bullish overall. I also recognize that the 6500 level above would be very difficult to overcome, but I think that eventually we will. Whether we can do between now and New Year’s is a completely different question, but I think that if you believe in the US indices overall, this market should have some catching up to do. Selling isn’t a thought.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement