Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast December 15, 2017, Technical Analysis

Updated: Dec 15, 2017, 06:36 GMT+00:00

The Dow Jones 30 and NASDAQ 100 pulled back during the trading session on Thursday, but it’s obvious to me that the algorithmic traders are trying to make a stand later in the day, and of course there is massive support just below.

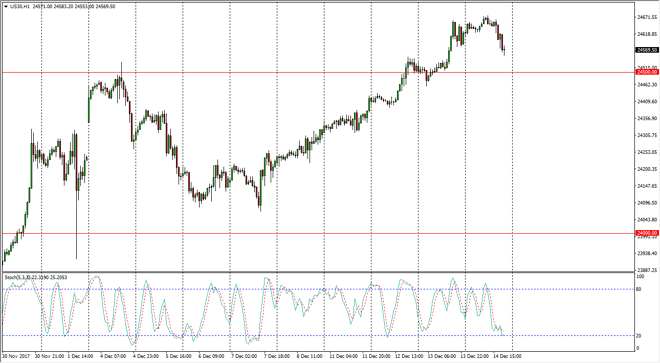

Dow Jones 30

The Dow Jones 30 initially tried to rally during the day but dipped towards the 24,550 level. I think that the 24,500 level is massively supportive, and that one can make a bit of an uptrend line on the hourly chart that could offer buying pressure as well. Algorithmic traders continue to pick up these dips, and I don’t think that’s going to change today. The market looks likely to look at these pullbacks as value and of course money managers are looking to pad their stats for the year, so they are desperately trying to make money in the market.

Dow Jones 30 and NASDAQ Index Video 15.12.17

NASDAQ 100

The NASDAQ 100 initially went sideways during the trading session on Thursday, but then broke down below the 6400 level. We saw enough buying pressure underneath to turn things around and form a hammer on the hourly chart though, and that is a sign that perhaps the NASDAQ 100 is ready to continue to go higher. With this, I think we will aim for the 6500 level above, which should be interesting for most people. I think I remain bullish in general, but I also recognize that the NASDAQ 100 is going to be a bit of a laggard when it comes to the US stock markets. I have no interest in shorting, and I believe that our rhythms continue to pick up the NASDAQ 100 as it has underperformed, and eventually we will play catch-up but in the meantime it’s probably easier to buy the Dow Jones 30.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement