Advertisement

Advertisement

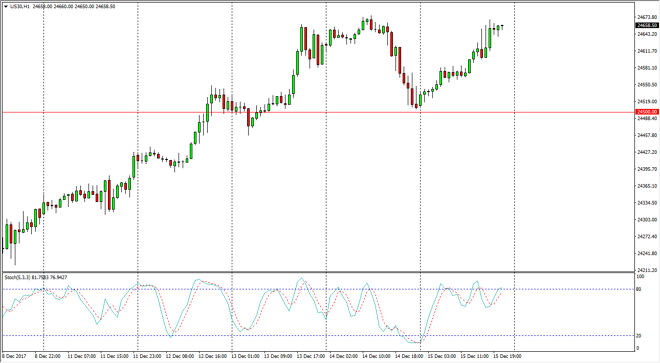

Dow Jones 30 and NASDAQ 100 Price Forecast December 18, 2017, Technical Analysis

Updated: Dec 16, 2017, 04:57 GMT+00:00

Dow Jones 30 and NASDAQ 100 traders both got excited as the tax reform seems to be likely to happen, and therefore it’s likely that the market would continue to attract buyers going forward, and therefore I think that the buyers are about to go into overdrive.

Dow Jones 30

The Dow Jones 30 rally during the session after Mark a Rubio stated he would support the Republican tax plan, which all but ensures a passage of the bill. Because of this, corporate profits next year should be larger, thereby offering an opportunity for the market to continue showing signs of strength. I think that we will eventually go looking towards the 25,000 level above, which of course is a large, round, psychologically significant number. Buying on the dips should continue to be the play, and adding as you go along should be the best way to profit from what has been a strong move.

Dow Jones 30 and NASDAQ Index Video 18.12.17

NASDAQ 100

The NASDAQ 100 has exploded to the upside, after initially going sideways at the 6400 level. The 6450 level above was broken as well, and it’s likely that we will continue to see buyers on dips. The 6500 level above will be targeted first, and that eventually we will break above there. The NASDAQ 100 has been lagging other indices in the United States, so it’s likely that we are trying to play catch-up. The market should continue to be very noisy, but quite frankly I think that we are now going to continue to see a lot of fresh money coming into the marketplace as traders tried to get their trading results higher for the end result of the year. If we were to break down below the 6400 level, that would be a very negative sign.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement