Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast December 27, 2017, Technical Analysis

Updated: Dec 27, 2017, 05:39 GMT+00:00

The Dow Jones 30 and NASDAQ 100 were very light on volume, as most traders will be away for holidays more than anything else. The light volume, not too much can be read into the marketplace beyond longer-term moves.

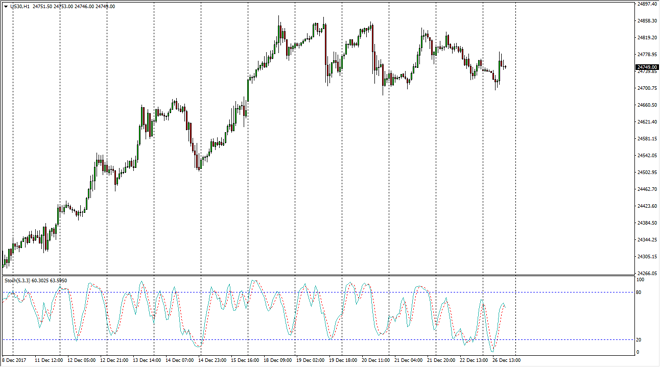

Dow Jones 30

The Dow Jones 30 went sideways initially during the day, but then rallied a bit. It looks as if the 24,700-level underneath should be supportive, and I think that eventually we will go to the 25,000 level above which of course is a large, round, psychologically significant number. That is an area that is somewhat resistive, but it’s going to take a while to break above there, as I think eventually we should go above there as well. The Dow Jones 30 of course is to benefit from the tax breaks that have been implemented in the United States, so therefore I think this continues to be a “buy on the dips” scenario, adding as the market works out in your favor.

Dow Jones 30 and NASDAQ Index Video 27.12.17

NASDAQ 100

The NASDAQ 100 fell during the day, and light volume. However, as I record this it looks as if the buyers are returning to support this market again. We will more than likely go looking towards the 6500 level above, which has been resistive more than once. As we pull back, it’s likely that we will continue to find volume and buyers underneath. These pullbacks continue to be an opportunity to take advantage of value, as the NASDAQ 100 has been a bit of a laggard when it comes to the US markets. I have no interest in shorting this market, least not until we would break down below the 6300 level. I think the one thing you can count on in this market is going to be volatility.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement