Advertisement

Advertisement

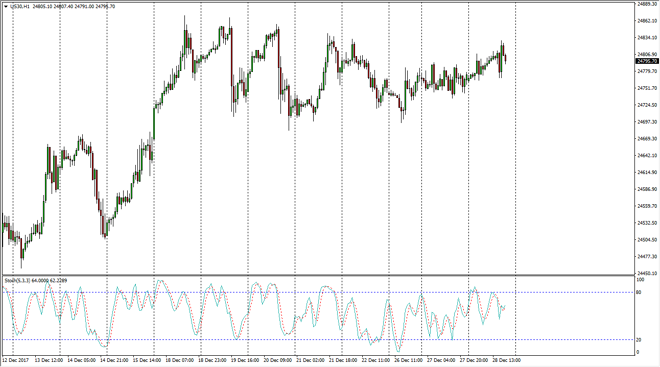

Dow Jones 30 and NASDAQ 100 Price Forecast December 29, 2017, Technical Analysis

Updated: Dec 29, 2017, 04:57 GMT+00:00

The Dow Jones 30 and NASDAQ 100 indices did very little during the trading session on Thursday, as we have a lack of liquidity in the marketplaces. Over the longer term, stock markets in the United States look very bullish, and it’s likely that the buyers will return.

Dow Jones 30

The Dow Jones 30 rallied a bit during the trading session on Thursday, but pulled back a little bit to look as if it is trying to build up momentum. At this point though, there is a very significant lack of volume, but ultimately, I believe that we will probably have to wait several days for the real volume to come back into the market, and then reach towards the 25,000 handle. Ultimately, this is a “buy on the dips” market, so algorithmic traders continue to lift it, but they’re not involved right now as most shops are close between the holidays.

Dow Jones 30 and NASDAQ Index Video 29.12.17

NASDAQ 100

The NASDAQ 100 also rallied during the session as well, but then pulled back to show signs of support underneath. If we can break above the 6450 level, that’s a very bullish sign that we should go looking towards the 6500 level. The 6400-level underneath is the “floor”, and that being the case the market will more than likely continue to find buyers, but volume is a serious concern, and I think that the NASDAQ 100 has trailed significantly, and it should continue to be a bit of a laggard when it comes to US indices. I believe that breaking above the 6520 level could be a very bullish sign, and it’s something that we could see eventually, but not until January. Add to your position slightly and slowly, as it gives you the opportunity to ride out the volatility.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement