Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast March 6, 2018, Technical Analysis

Updated: Mar 6, 2018, 05:25 GMT+00:00

US stock markets rallied on Monday, as traders came back to work from the weekend. This was true across all indices, not just the Dow Jones Industrial Average or the NASDAQ. I believe that given enough time, we are going to continue to try to go higher.

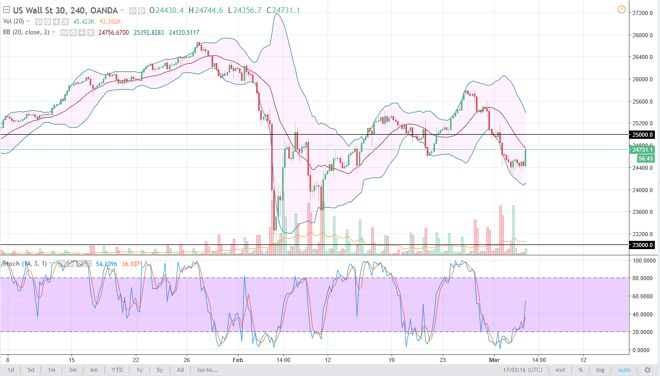

Dow Jones 30

The Dow Jones 30 has rallied significantly during the trading session on Monday, reaching towards the 20 SMA on the 4-hour chart. It looks very likely that we are going to continue to go to the 2500 level, an area that I think will attract a lot of attention. If we can clear that area significantly, the market is free to go much higher, perhaps the 26,000 level. Otherwise, I think we get a short-term burst to that level, and perhaps sellers could return it that area. This is a market that will be very noisy, and of course threatened by headlines of trade wars.

NASDAQ 100

The NASDAQ 100 has initially pulled back a bit during the trading session on Monday, but has turned around to rally significantly, perhaps reaching towards the 6900 level by the time you read this. If we can clear that level, I don’t see any reason the market won’t be able to attack the 7000 handle, an area that has been a significant amount of resistance. If we can clear there, the longer-term move in the NASDAQ 100 will certainly be to the upside, and I think that there is only a matter of time before we would reach much higher levels at that point. I think pullbacks would be bought, as it would become a “buy on the dips” scenario. If we were to break down below the 6700 level, then I think the market probably drops down to the 6500 level.

Dow Jones 30 and NASDAQ Index Video 06.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement