Advertisement

Advertisement

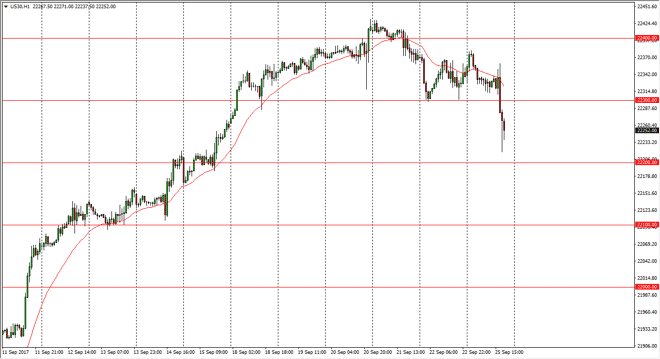

Dow Jones 30 and NASDAQ 100 Price Forecast September 26, 2017, Technical Analysis

Updated: Sep 26, 2017, 07:26 GMT+00:00

Dow Jones 30 The Dow Jones 30 fell during the session on Monday, breaking below the 22,300 level. The fact that we break down below there was rather

Dow Jones 30

The Dow Jones 30 fell during the session on Monday, breaking below the 22,300 level. The fact that we break down below there was rather negative, but towards the end of the session, we started to see buyers jump in. I believe that the nonsense coming out of North Korea will be overlooked relatively soon, and I think it’s only a matter of time before we rally again. If we can break above the 22,300 level, I believe that the market should continue to go higher and reach towards the 22,400 level. Ultimately, I believe in the overall uptrend, and this pullback should be a nice buying opportunity as it represents value in a nice uptrend. That doesn’t mean that it will be an easy trade, but I do think that the buyers will return.

Dow Jones 30 and NASDAQ Index Video 26.9.17

NASDAQ 100

The NASDAQ 100 really took it on the chin during the Monday session, slicing through the 5900 level. This market has been a bit of a laggard so it’s not a surprise that we fell harder over here. The 5850-level offered a bit of support, and I think that if we turn around and break towards the 5900 level, I would expect to see some type of resistance there. If we can break above 5900, I believe the market goes much higher, perhaps reaching towards the 6000 level. If we break down below the lows of the session, the market will probably go down to the 5800 level.

Technology continues to be sold off in general, as the market continues to find itself in some type of sector rotation, and I believe that industrial stocks will continue to outperform some of the previous high flyers, and therefore although I think that the NASDAQ 100 looks likely to rally, but will probably be slower than some of the other indices.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement