Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price Forecast for the Week of December 4, 2017, Technical Analysis

Updated: Dec 3, 2017, 09:27 GMT+00:00

With volatility peaking on Friday, we still saw the buyers come back into the marketplace, showing just how strong US stock markets are.

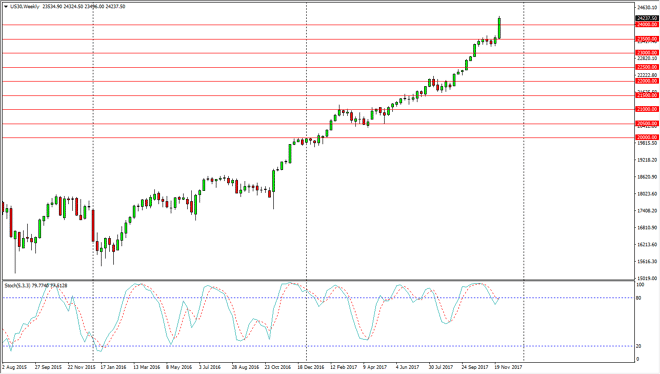

Dow Jones 30

The Dow Jones 30 broke out during the week, breaking above the 24,000 level again. By closing towards the top of the candle, it looks as if we are ready to continue the bullish run higher, and currently, it looks as if the 23,500 level is a bit of a floor. Obviously, algorithmic traders come in and pick up every short-term pullback, and I think that there is plenty of support at various levels underneath, so given enough time I think that the market will eventually go looking towards the 25,000 level, which is the next major round number. Expect the “Santa Claus rally” to come in full effect, but we do have a lot of volatility due to the General Flynn announcement during the Friday session that he was willing to testify against the White House.

Dow Jones 30 and NASDAQ Index Video 04.12.17

NASDAQ 100

The NASDAQ 100 got absolutely pummeled at one point during the week but turned around to form a nice-looking hammer. The hammer is pressing against the 6400 level, and it looks very likely that we are going to see this market go looking towards the 6500 level given enough time. Pullbacks remained buying opportunities as algorithmic traders jump into the marketplace, and continue to drive to the upside. I think that the 6000 level underneath is the “bottom or floor” of the overall trend. This is a market that continues to be very noisy, but quite frankly it’s likely that the algorithms will continue to pick up any time we see value as robots has taken over Wall Street trading. Keep your position size very small, if nothing else to protect your account.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement