Advertisement

Advertisement

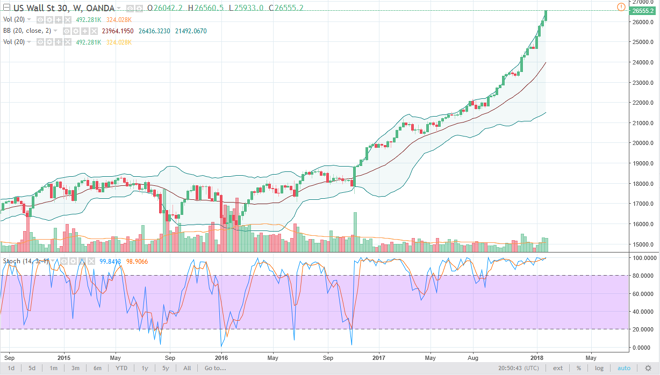

Dow Jones 30 and NASDAQ 100 Price forecast for the week of January 29, 2018, Technical Analysis

Updated: Jan 27, 2018, 05:48 GMT+00:00

US stock markets continue to rally during the week, breaking fresh, new highs yet again. It is getting a bit parabolic, so the longer-term trader is going to have to be very cautious.

Dow Jones 30

Obviously, one cannot sell the Dow Jones 30 anytime soon. The market is extraordinarily bullish, but longer-term traders are going to struggle with the idea of buying at this high level, because a pullback could involve a 1500-point move. The 25,000 level should be rather supportive at this point, and quite frankly I think it would be healthy if we pull back to that level. I believe that the market will eventually continue even higher, but longer-term traders need to see some type of value before they start investing in this market.

Dow Jones 30 and NASDAQ Index Video 29.01.18

NASDAQ 100

The NASDAQ 100 has exploded to the upside as well, clearing the 7000 level during late Friday trading. Because of this, I think it’s only a matter of time before we continue to go to the upside, but when I look at the Bollinger Bands, we are starting to get into the overbought area, and the stochastic oscillator has been pegged in the overbought condition for what seems to be ages. I think that pullbacks are necessary, but those are buying opportunities. The 6750-level underneath is the “floor” in the short-term uptrend, while the 6500 level is even more supportive for the longer-term move. I like buying dips, they represent value, but at this point it would be very difficult to go long of this market because of the significant pullback that will need to be had at one point or another. If you are not already long of this market, and you should be if you’ve been following me here at FX Empire, do yourself a favor and wait for value.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement