Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 Price forecast for the week of March 5, 2018, Technical Analysis

Updated: Mar 3, 2018, 05:31 GMT+00:00

The US stock markets initially tried to rally during the week but found enough resistance to turn around us or falling again. At this point, it looks as if were going to test the lows of February again, meaning that this could be a negative turn of events over the next couple of weeks.

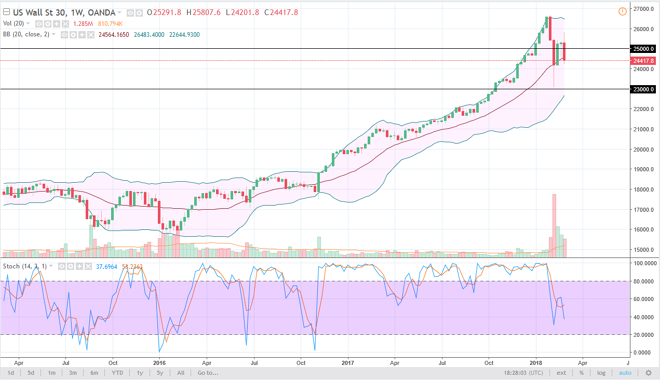

Dow Jones 30

The Dow Jones 30 initially tried to rally, reaching towards the 26,000 level. We turned around and fell significantly though, slicing through the 25,000 level, and breaking below the hammer from the previous week. This is a very negative sign and was exacerbated by Donald Trump announcing that there would be import tariffs placed upon steel and aluminum. Now we have fears of a trade war, and that is something that stock traders want nothing to do with. At this point, if we break down below the 23,000 level, the uptrend’s over and we should continue to go much lower. Otherwise, I think we have a short-term pullback that will eventually offer a bounce that we can take advantage of.

NASDAQ 100

The NASDAQ 100 rallied initially during the week but found enough resistance at 7000 to turn things around. We sliced through the 6700 level, forming a bit of a negative candle. I think we are susceptible to selling pressure now, but I think that the 6500-level underneath will offer quite a bit of support. Ultimately, I like the idea of buying a dip, or of course buying a break above the 7000 handle, which of course shows a massive break of resistance. If we break down below the lows from February, this market unwinds and goes much lower. In the meantime, I favor a slow drop.

Dow Jones 30 and NASDAQ Index Video 05.03.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement