Advertisement

Advertisement

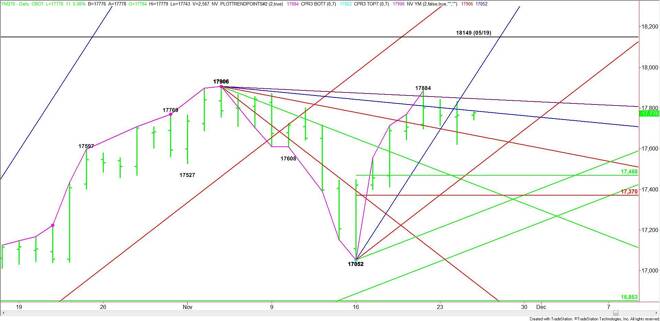

E-mini Dow Jones Industrial Average (YM) Futures Analysis – November 25, 2015 Forecast

By:

December E-mini Dow Jones Industrial Average futures managed to eke-out a small gain on Tuesday after an early market set-back. Early selling came in

December E-mini Dow Jones Industrial Average futures managed to eke-out a small gain on Tuesday after an early market set-back. Early selling came in reaction to the news that Turkey had shot down a Russian-made aircraft near Syria.

The main trend is up according to the daily swing chart, but upside momentum is slowing based on this week’s sideways price action.

Based on yesterday’s close at 17765, the direction of the market today is likely to be determined by trader reaction to a downtrending angle at 17786.

A sustained move over 17786 will signal the presence of buyers. This could trigger a rally into the next downtrending angle at 17846. This angle is followed by a minor top at 17884 and a main top at 17906.

Taking out 17906 with conviction could trigger a further rally into a steep uptrending angle at 17948.

A sustained move under 17786 will indicate the presence of sellers. The daily chart indicates there is room to the downside with the next target a downtrending angle at 17666.

The daily chart opens up to the downside under 17666 with the nearest support angle coming in at 17500.

If a main range forms between 17052 and 17884 then its retracement zone at 17468 to 17370 becomes the primary downside target.

Watch the price action and read the order flow at 17786 today. Trader reaction to this angle will tell us whether the bulls or the bears are in control. Today is also the seventh day up from the 17052 bottom, putting the Dow in the window of time for a potentially bearish closing price reversal top. If a trade through 17884 is followed by a lower close then this will signal that the selling is greater than the buying at current price levels.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement