Advertisement

Advertisement

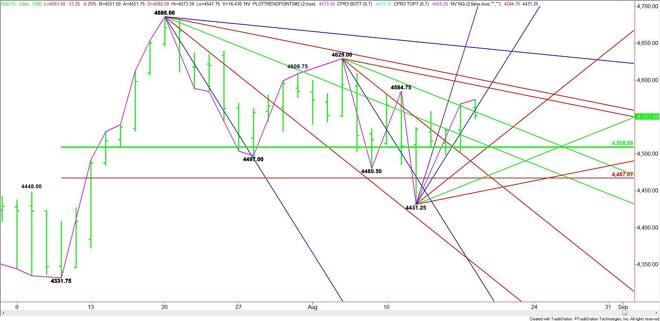

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – August 18, 2015 Forecast

By:

September E-mini NASDAQ-100 Index futures are expected to open weaker based on the pre-market trade. The market rallied early in the session, but failed

September E-mini NASDAQ-100 Index futures are expected to open weaker based on the pre-market trade. The market rallied early in the session, but failed to take out the previous swing top at 4584.75, encouraging buyers to book profits.

The current price at 4551.50 has put the market on the weak side of a price cluster at 4557.00 to 4559.25. Trader reaction to this zone will set the direction of the market today.

A sustained move over 4559.25 could create enough upside momentum to challenge the main top at 4584.75. A trade through this level will turn the main trend to up. This could trigger a surge into a pair of downtrending angles at 4593.00 and 4602.00.

The trigger point for another surge to the upside is 4602.00. Taking this level out with conviction could trigger a move into the next main top at 4629.00.

A failure at 4557.00 will signal the presence of sellers. The daily chart indicates there is plenty of room to the downside. The next likely targets come in at 4518.00, 4508.75 and 4495.25.

Watch the price action and read the order flow at 4557.00 and 4559.25. A sustained move over 4559.25 will set a bullish tone. A sustained move under 4557.00 will set a bearish tone.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement